Economic growth is expected to continue to slow in 2024. Higher interest rates are anticipated to weigh more heavily on Canadian consumers and overall economic activity in 2024. Higher rates have had a disproportionately negative impact on Canadians due to higher consumer debt levels and shorter duration mortgages compared to the U.S. Unemployment is also expected to continue to increase at a slightly higher pace compared to 2023.

2023 overview

Canada’s GDP growth has decelerated materially in the third quarter, .jpg?width=317&height=211&name=GettyImages-936349846%20(1).jpg) coming in at -1.1% in Q3 despite positive levels in Q1 (+2.5%) and Q2 (+1.4%). Canadian GDP has lagged U.S. growth substantially in Q2 (+2.1%) and Q3 (+5.2%).

coming in at -1.1% in Q3 despite positive levels in Q1 (+2.5%) and Q2 (+1.4%). Canadian GDP has lagged U.S. growth substantially in Q2 (+2.1%) and Q3 (+5.2%).

In another sign of a slowdown, unemployment also increased modestly from 5% in Q1 to 5.5% in Q3. Official GDP figures will be released on February 29, 2024. However, if the consensus view that Canada’s GDP grows by 0.2% in the fourth quarter proves to be correct, a recession will be narrowly avoided.

With inflation slowing, the Bank of Canada increased the overnight rate modestly in 2023 (from 4.5% to 5%) compared to the previous year. It has also signaled that it will hold rates steady for the time being, but are not ruling out additional rate hikes at this time.

Canadian equities have experienced a decent 2023, with the S&P/TSX Composite Index closing the year up 11.8%, but lagging behind the S&P 500 Index (+22.9%), MSCI World EAFE Index (+15.6%) and the Tokyo Stock Price Index (TOPIX) (+16.8%).1

.jpg?width=275&height=183&name=GettyImages-185101499%20(1).jpg) Canadian equities are heavily skewed toward interest rate-sensitive sectors that include Canadian banks, energy pipeline companies, telecommunication companies, utilities and real estate investment trusts (REITs). These dividend-paying equity sectors can serve as bond proxies. As rates have increased, capital has been drawn away from these sectors and reallocated to risk-free investments that offer much higher yields compared to the recent past. These sectors of the market also tend to require significant capital, which has become more expensive.

Canadian equities are heavily skewed toward interest rate-sensitive sectors that include Canadian banks, energy pipeline companies, telecommunication companies, utilities and real estate investment trusts (REITs). These dividend-paying equity sectors can serve as bond proxies. As rates have increased, capital has been drawn away from these sectors and reallocated to risk-free investments that offer much higher yields compared to the recent past. These sectors of the market also tend to require significant capital, which has become more expensive.

Elsewhere in the market, energy has performed roughly in line with  the S&P/TSX Composite Index, with a significant positive contribution from oil producers that has offset the underperformance of pipelines. Technology significantly outperformed in 2023, although this outperformance was mostly attributable to two stocks, including Shopify Inc. and to a lesser extent, Constellation Software Inc. Gold equities underperformed the S&P/TSX Composite Index in 2023 despite the price of gold finishing the year up 13.1% as of December 31, 2023.2

the S&P/TSX Composite Index, with a significant positive contribution from oil producers that has offset the underperformance of pipelines. Technology significantly outperformed in 2023, although this outperformance was mostly attributable to two stocks, including Shopify Inc. and to a lesser extent, Constellation Software Inc. Gold equities underperformed the S&P/TSX Composite Index in 2023 despite the price of gold finishing the year up 13.1% as of December 31, 2023.2

2024 Canadian equities outlook

Economic growth is expected to continue to slow in 2024. Higher interest rates are anticipated to weigh more heavily on Canadian consumers and overall economic activity in 2024. Higher rates have had a disproportionately negative impact on Canadians due to higher consumer debt levels and shorter duration mortgages compared to the U.S. Unemployment is also to continue to increase at a slightly higher pace compared to 2023.

The federal government announced a plan to increase permanent resident admissions to 485,000 in 2024. We believe that elevated levels of immigration could act as an offsetting factor. The market view is that the Bank of Canada will begin to cut rates in April 2024 given slowing macroeconomic growth and easing inflation. We believe, however, that the timeline is overly optimistic.

A few sectors that we will continue to monitor as we head into the new year include banks, housing, and energy.

Banks

Canadian banks are expected to continue to increase provisions for credit losses in  response to the negative impact of higher rates on Canadian consumers, whose household debt levels are 187% of net disposable income, among the highest in the Organization for Economic Co-operation and Development (OECD).3 Higher credit losses and further provisioning are expected to be driven primarily by the banks’ non-mortgage loan books (such as personal auto loans, credit cards, etc.), which will continue to pressure bank earnings in 2024.

response to the negative impact of higher rates on Canadian consumers, whose household debt levels are 187% of net disposable income, among the highest in the Organization for Economic Co-operation and Development (OECD).3 Higher credit losses and further provisioning are expected to be driven primarily by the banks’ non-mortgage loan books (such as personal auto loans, credit cards, etc.), which will continue to pressure bank earnings in 2024.

Housing

The Canadian housing and mortgage markets will continue to remain topical as inflation and elevated borrowing costs have taken a toll on affordability. The Bank of Canada rate cuts that are expected to take place in 2024 may bring some relief to mortgage holders, however, the impact on housing prices is less clear. Re/Max recently published a forecast that indicated average home prices will grow by only 0.5% in 2024.4

Energy

Multiple factors are supportive of oil prices heading into the new year. Supply-side dynamics remain attractive, primarily due to a long history of underinvestment in oil production. In addition, the OPEC+ organization has proven to be very aggressive in curtailing oil production to support oil prices. Ongoing conflicts also continue to introduce significant risks to global oil supply. These supportive factors for oil prices could be offset by the uncertainty surrounding oil demand, given the uncertain economic outlook for 2024, in particular the expectation of slowing economic growth.

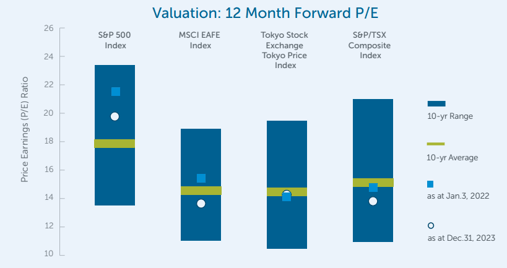

While there are several economic headwinds that are expected to negatively impact the Canadian economy, as discussed above, a slowdown in inflation and the expectation that we begin to see rate cuts will help to offset these headwinds. In addition, valuation levels of Canadian equities are at a meaningful discount relative to historical averages.

Source: Bloomberg as of December 31, 2023. US equities are represented by the S&P 500 Index, Canadian equities are represented by the S&P/TSX Composite Index, Japanese equities are represented by the Tokyo Stock Exchange Tokyo Price Index (TOPIX), and international equities are represented by the MSCI EAFE Index.

Source: Bloomberg as of December 31, 2023. US equities are represented by the S&P 500 Index, Canadian equities are represented by the S&P/TSX Composite Index, Japanese equities are represented by the Tokyo Stock Exchange Tokyo Price Index (TOPIX), and international equities are represented by the MSCI EAFE Index.

![]() Download the full Empire Life 2024 Market Outlook (PDF).

Download the full Empire Life 2024 Market Outlook (PDF).

1 Indexes are total return versions, as of December 31, 2023 in Canadian dollars.

2 Spot price of gold in USD per ounce. Source: Bloomberg as of December 31, 2023

3 OECD, 2023 https://data.oecd.org/hha/household-debt.htm

4 Re/Max National Market Outlook https://blog.remax.ca/canadian-housing-market-outlook/

This document reflects the views of Empire Life as of the date published. The information in this document is for general information purposes only and is not to be construed as providing legal, tax, financial or professional advice. The Empire Life Insurance Company assumes no responsibility for any reliance on or misuse or omissions of the information contained in this document. Please seek professional advice before making any decisions.

Policies are issued by The Empire Life Insurance Company. A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value. Past performance is no guarantee of future performance.

Information contained in this report has been obtained from third party sources believed to be reliable, but accuracy cannot be guaranteed. Empire Life Investments Inc. is the Portfolio Manager of certain Empire Life segregated funds. Empire Life Investments Inc. is a wholly-owned subsidiary of The Empire Life Insurance Company.

March 2024