Understanding the Date Last Insured (DLI) is crucial when applying for Social Security Disability Insurance (SSDI). The DLI serves as a cutoff point for individuals seeking SSDI benefits. But what exactly does it mean, and why is it significant?

Understanding Date Last Insured (DLI)

The Date Last Insured represents the last date a person is eligible to receive SSDI benefits. If you file your Social Security Disability claim after your DLI has passed, you must prove your disability started before this date. Once Social Security approves your claim, the date last insured no longer matters because your benefits will continue.

How the SSA Calculates Your DLI

The SSA calculates your DLI based on your last day of work and the quarters of coverage (or work credits) accumulated during employment. Quarters of coverage represent how long you worked and paid Social Security taxes. You must have worked and accumulated enough quarters of coverage to be eligible for SSDI benefits.

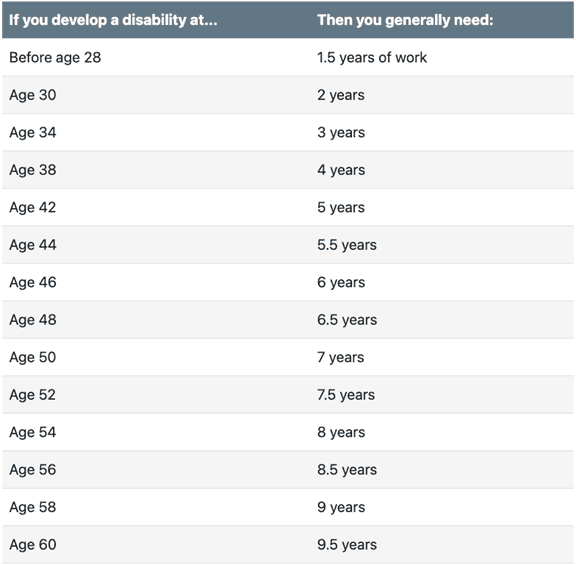

For those aged 31 and above, the number of work credits needed for Social Security Disability Insurance depends on your age when you become disabled. Generally, you need 40 credits, with 20 of those earned in the last 10 years before becoming disabled. Younger applicants require fewer work credits to qualify for SSDI benefits.

Here is a chart from the Social Security Administration:

It is important to note that when you stop working at a job that pays into Social Security, you have around five years after leaving employment before reaching your DLI. Many claimants are shocked to learn that their work credits expire.

Examples of How Your DLI Can Affect Your Claim

Understanding the Date Last Insured (DLI) can be confusing because of the complex rules. Let’s look at an example from different angles to clarify it:

You’ve earned enough credits to qualify for Social Security Disability Insurance (SSDI). You worked for five out of the last ten years, and your coverage started when you stopped working in December 2017. Social Security notified you that your SSDI eligibility expires on December 31, 2022. This date is your DLI (five years after your last job).

What does this mean for you? Do you lose benefits on December 31, 2022, or are you still insured?

- Example 1: You didn’t work during those five years. If you became disabled in December 2017 and apply for SSDI before December 31, 2022, you qualify if you can prove your disability started before that date.

- Example 2: You stopped working while healthy in December 2017 and didn’t work from 2018 to 2022. In September 2022, you returned to full-time work but got seriously injured a week later and stopped working. As you recover, you need SSDI benefits. It’s now July 2023. Social Security will ask when your disability started. You say September 2022 and have medical records to support it. You’re eligible for SSDI because your disability onset was before your DLI on December 31, 2022.

- Example 3: This is where many claimants struggle. Using the same example, you stopped working in December 2017 with a DLI of December 31, 2022. But this time, you returned to work in November 2022 and became disabled on January 1, 2023. You apply for SSDI with proof of disability on January 1, 2023. You won’t qualify based on your earnings because you’re outside the “5-year window” of insurance coverage. Your SSDI eligibility ended on December 31, 2022, but your disability application is based on January 1, 2023 records.

Note: Understanding your DLI is essential for ensuring you have sufficient work credits to qualify for Social Security Disability benefits if you cannot work due to a severe medical condition. However, your DLI does not affect Supplemental Security Income (SSI) benefits eligibility.

Was Your Claim Denied Because of Your Date Last Insured?

As you navigate the complexities of your Social Security Disability claim, remember that many SSDI denials are because of DLI issues. Calculating DLI is complicated, and mistakes happen. Sometimes, medical proof is questionable, or disabilities lack a clear origin. However, further investigation may clarify an incorrect disability onset date or an incorrect determination that you became disabled after your DLI expired.

If your date last insured is causing a problem in your case, an attorney specializing in SSDI law can be vital to getting the benefits you deserve. Contact Ortiz Law Firm online or call us at (888) 321-8131 to discuss the specifics of your case and whether we can help you appeal the denial of your claim.

Sources

- Social Security. “Social Security Credits.” Retrieved from: (https://www.ssa.gov/benefits/retirement/planner/credits.html) Accessed on April 15, 2024.

- Social Security. “Program Operations Manual System (POMS).” Retrieved from: (https://secure.ssa.gov/poms.nsf/lnx/0425501320) Accessed on April 15, 2024.

Last Updated: April 15, 2024 // Reviewed and Edited by: Ortiz Law Firm