Flood damage can severely impact commercial properties, potentially crippling a business. Standard commercial property insurance does not cover damage from flooding, making a specific commercial flood insurance policy crucial for protection against such events.

What’s the difference between commercial property insurance and commercial flood insurance?

While commercial property insurance covers a range of risks, it typically excludes flood damage. Commercial flood insurance is designed specifically to cover damages caused by flooding, including the building and contents within it, ensuring your business’s physical assets are protected. It can also cover business interruption coverage with private flood insurance companies.

How does FEMA relate to commercial flood insurance?

The Federal Emergency Management Agency (FEMA) manages the National Flood Insurance Program (NFIP) which offers standard flood insurance policies to commercial property owners. FEMA provides resources, including flood maps and the flood insurance manual, to help businesses understand their risk and coverage options.

What is replacement cost vs. actual cash value in flood policies?

Replacement cost coverage pays the cost to replace your damaged property without deducting depreciation, ideal for new buildings or recently renovated properties. Actual cash value, however, pays out based on the value of items at the time of loss, including depreciation, which might not cover the full cost of replacement.

How can I obtain flood insurance for my commercial property?

Business owners can obtain flood insurance through the NFIP or private insurance providers. The process involves assessing your property’s risk, deciding on the amount of coverage needed, and contacting a local insurance agent or using an insurance provider locator tool.

What’s the maximum amount of insurance available for commercial properties?

NFIP provides up to $500,000 of coverage for the building and an additional $500,000 for its contents. If your coverage needs exceed this limit, you might consider purchasing excess coverage from private insurers.

Is there a waiting period for flood insurance policies to take effect?

Yes, there’s typically a 30-day waiting period from the date of purchase before a new flood insurance policy goes into effect. This period is to prevent claims for imminent flooding events and ensures that coverage is procured well before a flood event occurs.

One exception to wait periods on flood insurance is if you have a loan closing on a property.

Do flood policies cover personal property within commercial buildings?

Yes, commercial flood insurance policies offer building and contents coverage, which includes personal property and business property within the building. It’s vital to assess the value of these items to ensure adequate coverage.

Are all commercial properties required to purchase flood insurance?

Properties located in high-risk flood zones; which generally are flood zones A and V, and mortgaged from federally regulated or insured lenders are required to obtain flood insurance. It’s also prudent for businesses outside these areas to consider coverage, given that flooding can happen anywhere.

How are commercial flood insurance premiums determined?

Premiums for commercial flood insurance can range widely, based on factors like the property’s location, flood zone, risk of flooding, and the chosen deductible and coverage limits. Utilizing flood maps and consulting with insurance experts can help estimate these costs accurately.

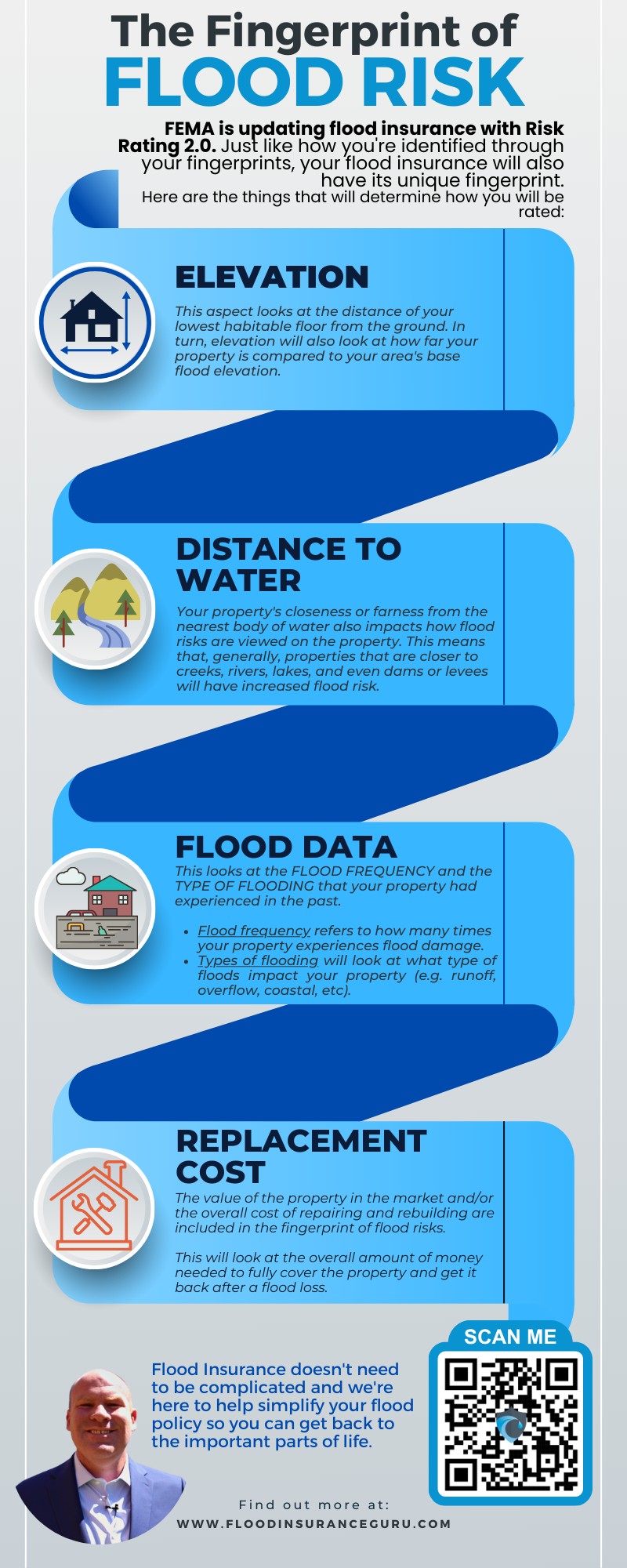

This is what we call the fingerprint of flood risk. You can click this graphic below and save it for future use if you need to go back and review what determines flood pricing.

What types of coverage are available for commercial flood insurance?

There are two primary types of coverage: building property coverage, which pays for the physical damages to the structure itself, and personal property (or contents) coverage, which covers the items within the building. Policyholders can select the coverage that best fits their needs, including optional replacement cost coverage for buildings.

How do policyholders file flood insurance claims?

In the event of a loss, policyholders should promptly contact their insurance provider to file a claim. Documentation of the damage, including photos and a detailed inventory of losses, will be necessary to support the claim and determine the payout based on the policy’s terms.

Navigating commercial flood insurance can seem daunting, but understanding your coverage needs, the risks your property faces, and the options available to you is key to protecting your business investment. Whether through the NFIP or a private insurance provider, securing the right policy to protect against flood damage is an essential step for any commercial property owner.

Before You Leave

In conclusion, securing commercial flood insurance is a critical step for business owners looking to safeguard their commercial properties from the devastating effects of flooding.

Understanding the differences between commercial property insurance and flood insurance, the coverage options available, and the factors influencing premiums, are all vital pieces of knowledge that can help protect your business’s physical assets and financial stability. Whether your property is in a high-risk flood zone or an area that has never experienced flooding, it’s clear that no location is immune to the possibility of flood events.

Therefore, assessing your risk, obtaining the right coverage, and preparing for potential claims should be integral components of your business’s risk management strategy.

With FEMA and the NFIP providing guidelines and coverage, alongside private insurance options offering additional flexibility and excess coverage, there’s a suite of choices available to meet every commercial property’s needs.

Remember, the 30-day waiting period for new policies means that the time to act is well before any imminent threat. By making informed decisions about flood insurance, you not only protect your property but also ensure the continuity of your business operations in the face of natural disasters.

In the dynamic landscape of commercial real estate, being proactive about flood insurance is not just wise—it’s essential for long-term resilience and success.