You bought flood insurance to protect your home, but will your lender accept it?

What if your policy gets rejected right before closing, costing you time, money, or worse, the deal itself?

This happens more often than homeowners expect.

You did everything right: purchased flood coverage, followed lender instructions, and submitted what seemed like a complete policy. But now your bank is pushing back, asking for different documents or saying the policy does not meet federal standards.

In this article, you’ll learn:

-

Why some flood insurance policies get rejected

-

What coverage, deductibles, and language lenders require

-

How NFIP and private flood options compare

-

What documentation you need to avoid delays

-

How to make sure your flood policy is compliant before closing

Why Banks Reject Flood Insurance Policies

If your home is in a high-risk flood zone, lenders are legally required to verify that your flood insurance meets federal and institutional requirements. Just having coverage is not enough, it must meet exact standards.

Common Rejection Reasons:

1. Deductible is Too High

Most lenders require deductibles to be $10,000 or less. Higher deductibles shift too much risk onto the borrower and are typically not allowed.

2. Inadequate Coverage

Your flood policy must cover at least:

-

Your mortgage balance

-

Your home’s replacement cost

-

Or the NFIP maximums ($250,000 for structure, $100,000 for contents)

Whichever is less.

3. Private Policy Missing Required Clauses

Many private flood policies get rejected because they lack federally mandated language, such as:

What Flood Coverage Lenders Require

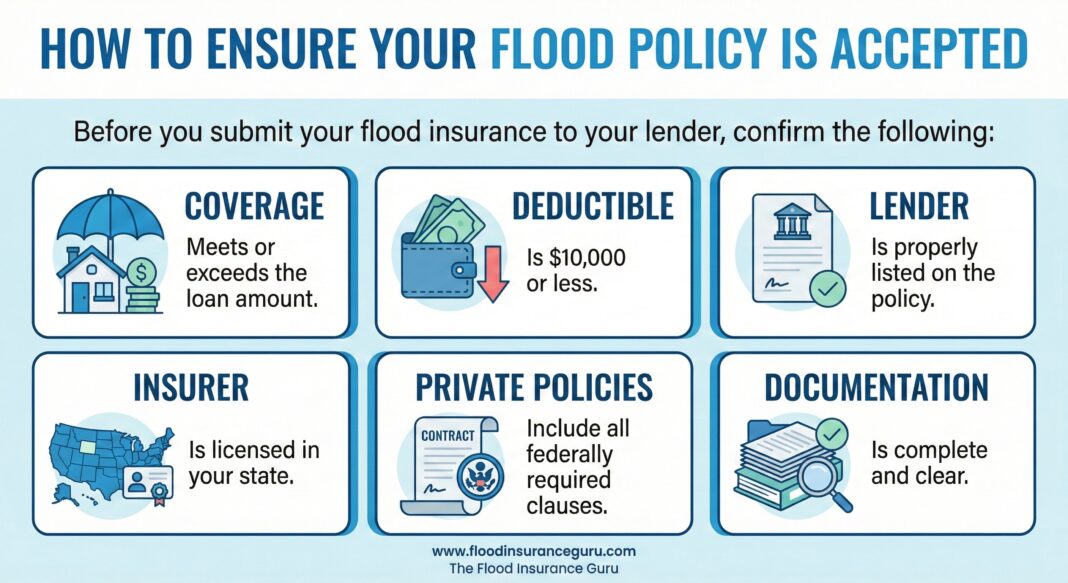

To meet lender expectations, your flood insurance policy should include:

-

Adequate coverage: Meeting or exceeding loan requirements

-

Deductible: $10,000 or less

-

Lender as loss payee: Your bank must be listed on the policy

-

Licensed carrier: The insurer must be authorized in your state, with a solid financial rating

-

Full documentation: Signed application, paid receipt, declarations page

Will Lenders Accept NFIP and Private Flood Insurance?

NFIP Policies

-

Accepted by all federally backed mortgage lenders

-

If your lender is paying, a signed NFIP application serves as valid proof of coverage for up to 29 days

-

Coverage is capped at $250,000 for the building and $100,000 for contents

Private Flood Insurance

-

Accepted by most lenders if it meets federal compliance standards

-

Must include specific clauses:

-

Must be paid in full before binding

-

Requires documentation: declarations page, receipt, and lender listed properly

Frequently Asked Questions

Will my lender accept private flood insurance?

Yes, if it meets all federal compliance requirements. This includes specific clauses and documentation confirming the policy is equivalent to NFIP coverage.

What documents do I need to submit to my bank?

You typically need:

Does NFIP flood insurance have to be paid up front?

Not if your lender is paying. In that case, a signed NFIP application serves as proof for up to 29 days. If you are paying, the premium must be submitted before closing.

Why would a lender reject my flood policy?

Most rejections come from:

-

High deductibles

-

Missing clauses in private flood policies

-

Lenders not listed on the declarations page

-

Using a carrier that is not licensed in your state

Coverage Isn’t Enough, Lender Compliance Is Key

Buying flood insurance is a smart move, but buying the right policy, one your lender will actually accept, is what keeps your mortgage protected and your closing on track.

At the Flood Insurance Guru, we help you:

-

Choose a lender-approved flood policy

-

Navigate NFIP and private options with clarity

-

Submit complete documentation that meets federal guidelines

Avoid surprises. Move forward with confidence.