Editor’s note: First published 2016 | Refreshed November 2025 with updated Irish claim-refusal data, insurer examples, and internal links.

If you’re thinking about life insurance but wondering,

Will they actually pay out if I croak it?

— it’s a fair question.

Trusting an insurance company is the last thing I’d expect from you! They’re not known for generosity. And the T&Cs? Like trying to read Ulysses — but less clear and with more clauses.

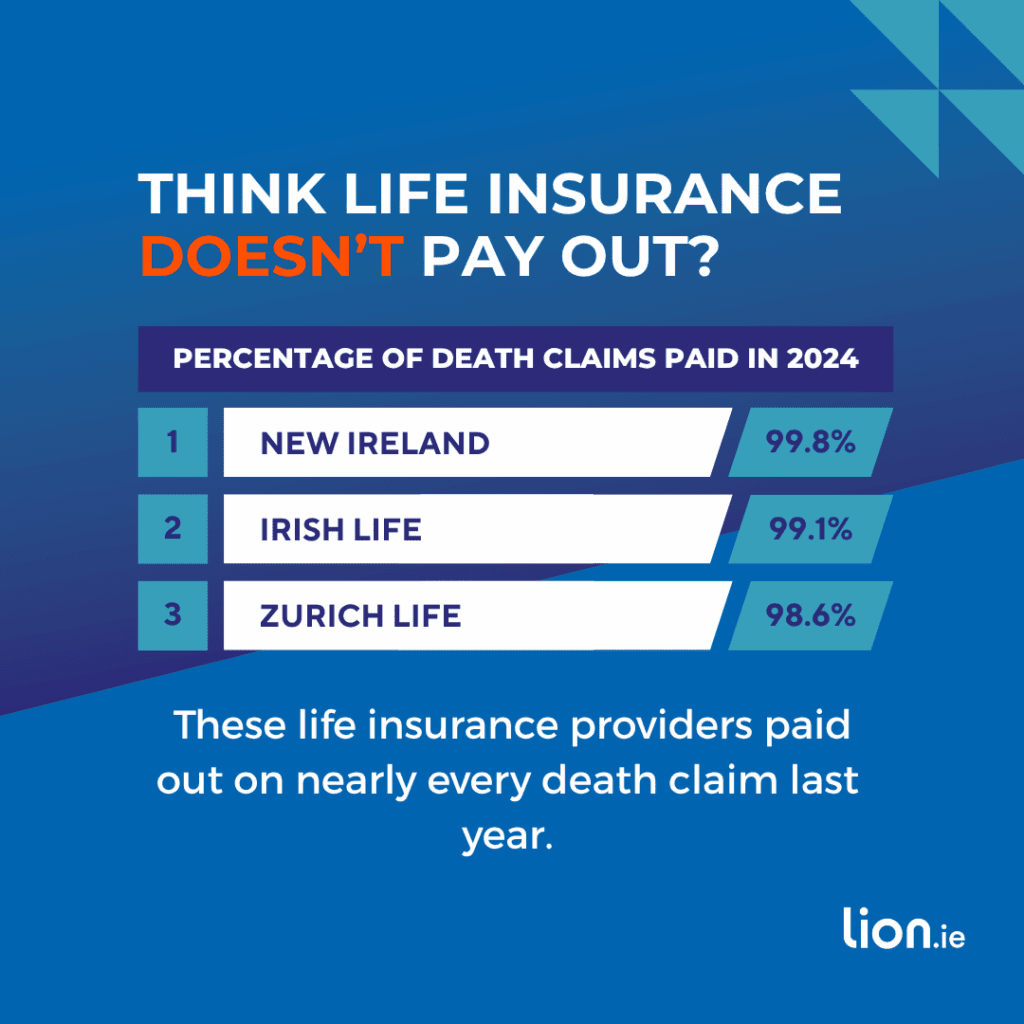

But most life insurance claims in Ireland do get paid. Only around 2–3 % are refused — and almost always for the same few reasons. When they don’t, it usually boils down to one of three things:

You Didn’t Tell the Full Story (a.k.a. Non-Disclosure)

Ah sure, I didn’t think that was important.

You meant to be honest… but forgot about the high blood pressure. Or the social smoking. Or that time you were in A&E because your heart was going bananas.

Insurers call these material facts — anything that would’ve affected your price or cover. They don’t expect you to be a walking medical file, but if you’re asked something and you lie (or “forget”), your claim could be toast.

Real example: One of our clients claimed to be a non-smoker. Her GP’s notes said otherwise. Claim refused. Simple as that.

You Stopped Paying (Lapsed Policy)

This one hurts because it’s so avoidable.

You miss a payment. Think, “I’ll sort that next week.” But you don’t. After 30 days, your mortgage protection policy lapses. No cover. No payout.

It’s like cancelling Netflix, then being shocked when Drive to Survive won’t load.

If it was a banking issue or just life getting in the way, let us know before it gets cancelled. We can usually sort it. But if you leave it too long, that’s that.

You Tried to Pull a Fast One (Fraud)

This is rare — but not that rare. And insurers? They love a good investigation. You try something dodgy, they go full CSI.

- Faking your death

- Forging medical reports

- Counterfeit medical certs

- Applying to six insurers for €5 million cover and not telling a single one about the others

Yes, someone tried that. Spoiler: didn’t end well.

“But What If the Lie Had Nothing to Do with the Death?”

Let’s say you lied about smoking, but died in a car crash. No connection, right?

Well… some insurers might still pay out — as a goodwill gesture. Others won’t.

If they reckon they wouldn’t have given you the same policy at that price had they known the full story, they can void the policy ab initio (legalese for “this never existed”).

So while you might get lucky, would you bet your family’s future on that?

If you’ve had a cigarette in the past 12 months, admit it. Pay the higher premium for a year. Then re-apply as a non-smoker when you’re in the clear.

Real Claims That Were Refused

These are all genuine:

- Hospitalised for high blood pressure a month before applying — didn’t mention it

- Claimed to be a non-smoker but had nicotine in their system at death

- Going for tests for bowel issues — left that out (insurer would’ve postponed cover)

- Told to attend AA — “forgot” to mention it

Most of the time, it’s not even malicious. But insurers don’t need malice — just a reason.

Extra reading: what happens when you make a life insurance claim.

When It Goes Right

One of our clients died by suicide 💔

The insurer found a history of mild depression in his medical records — something he hadn’t disclosed. Technically, they could have refused the claim. But they didn’t. They said it wouldn’t have changed the premium — and paid out in full.

The insurers do take a human approach, hence the 98 % claims-payout rate in Ireland.

How to Avoid Your Claim Being Denied

Tell the truth.

Even if you’re not sure something’s relevant, tell us. We’ll run it past the insurer anonymously before you apply — no harm done.

At Lion.ie, we don’t sugar-coat things. We ask awkward questions. We nag you to fill out that one final form.

Because if the worst happens, we want your claim to fly through — not get stuck on something stupid.

This is especially important for income protection, by the way. That stuff’s even stricter than life insurance.

Can You Prevent a Claim Refusal?

Before you apply or update your policy, double-check:

– Are all health questions fully answered?

– Is your GP aware of every medication or test mentioned?

– Are payments set to auto-debit so nothing lapses?

TL;DR

Most claims get paid. When they don’t, it’s usually because of:

- Something you didn’t disclose

- A missed payment

- Fraud (or something dodgy)

If in doubt, ask us. For the step-by-step process of making a claim, see what happens when you make a life insurance claim.

Over to You

If you’re not sure what you need to disclose — or want us to look over something before you apply — fill out this short questionnaire or drop me a message.

We’ll help you keep your cover clean and your claim future-proofed.

Thanks for reading

Nick

Making life insurance less crap since 2011. 🦁

Written by Nick McGowan, QFA RPA APA

Nick is a qualified financial advisor and founder of Lion.ie, a life-insurance and income-protection brokerage based in Tullamore.

He’s been helping people get fair, transparent cover for over 20 years — and was named Protection Broker of the Year 2022.

Learn more about Nick