More than a third of family office clients recently surveyed by UBS Group AG plan to increase their allocations to direct private equity opportunities, behind only developed-market equities as the most popular asset class.

The participation of private wealth underscores the growing sophistication of how the people behind the world’s biggest fortunes are managing their money, as well as how many investment firms are increasingly tapping them as sources of capital.

Blackstone Inc., KKR and Carlyle Group Inc. have already started dedicated platforms to serve the well-heeled, and the richest among them are able to become partners for some of those firms’ most high-profile — and possibly most lucrative — deals.

“They have the potential to take on long-term opportunities,” Christina Wing, founder of advisory firm Wingspan Legacy Partners, said of the ultra-rich. “They are going to come in at the same terms as institutional investors.”

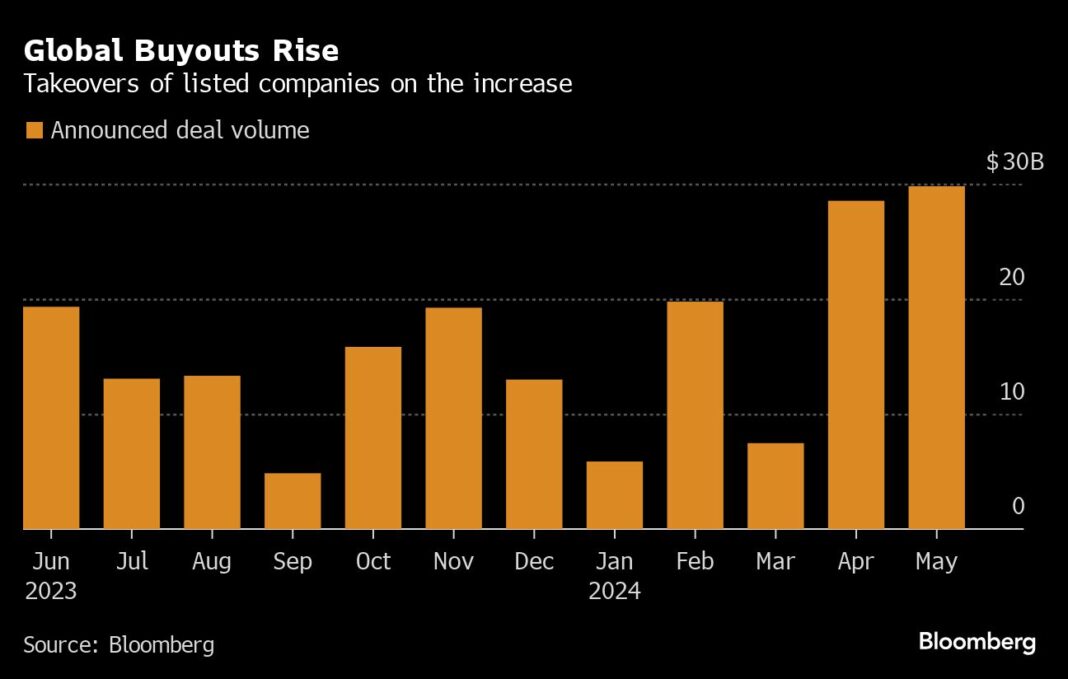

Deal Shift

The pace of dealmaking by wealthy families has been steadily increasing in recent years. When Brookfield Asset Management agreed to buy Network International Holdings Plc last year, Saudi Arabia’s billionaire Olayan family contributed nearly a tenth of the £2.2 billion ($2.8 billion) purchase price for the London-listed payments processor.

In 2022, private equity firm EQT AB teamed up with the pharmaceutical billionaires in Germany’s Struengmann family as it pursued a bid for Novartis AG’s $25 billion generic drugs business, Bloomberg News reported at the time.

Overall, the family led by identical twins Thomas and Andreas Struengmann has worked with the Swedish private equity giant on at least six major deals within the past decade, according to data compiled by Bloomberg.

Past deals show the potentially outsized returns available from buyout deals involving publicly traded companies.

Michael Dell transformed his technology empire after striking a deal with Silver Lake to take his namesake business private in 2013 through a $25 billion leveraged buyout, allowing him to reposition the Texas-based company outside the glare of public markets.

It relisted five years later in stronger financial shape, with Dell’s stake in the company he founded in his college bedroom now making up most of his $107.2 billion fortune, according to Bloomberg’s wealth index.

Other members of the world’s wealthiest families are following suit. Reinold Geiger, the billionaire Austrian owner of L’Occitane International SA, is trying to buy out minority shareholders in the skin-care company with financing from Blackstone and Goldman Sachs.

The billionaire dynasty behind U.S. clothing retailer Nordstrom Inc. has been considering a similar move. And Rothschild & Co.’s founding family bought out other investors in the storied bank last year with capital from several other wealthy clans, including the owners of luxury fashion house Chanel and Dassault Systemes SE.

“It’s some of the best capital for our banking colleagues,” Goldman’s Allaway said, referring to funds from the world’s ultra-rich. It will “become more of a permanent capital base for these type of transactions.”

(Image: Shutterstock)