Long-term care insurance can offer many benefits if you end up needing it in the future. For example, long-term care insurance can cover most, if not all of your expenses if you:

Of course you don’t want this to be your situation; however, having this policy can improve your quality of life significantly if you ever did need to use it. It can remove some of the pressure from your family members, who may not be able to care for you in the ways you need.

Long-term care policies can also allow you to stay in your home longer, as opposed to moving into a nursing home or assisted living facility. If you have a family history of disability or chronic illness, you may want to prepare for these possibilities for yourself.

A long-term care insurance policy can bring you peace of mind even before you need care. Long-term care policies can also be cheaper than paying out of pocket. It’s estimated it takes around $1.5 million in savings to cover care on your own.

An insurance policy relieves you of accumulating funds that you could leave to your family in the future. Lastly, long-term care insurance policies almost always offer your family a death benefit, which you can’t get from many other policy types.

While long-term care insurance policies can offer you many benefits, they are not without disadvantages.

Long-term care insurance isn’t right for everyone, and its advantage to you depends on several factors unique to your situation.

While you may consider all the types of care this insurance covers, you must also take into account the likelihood that you will need long-term care services in the future.

If you find the prospect unlikely, you have other insurance options. If you do purchase long-term care insurance but don’t need the coverage later in life, you lose some of your funds and would have invested in something you didn’t need.

While the policy may still give your family a death benefit, it won’t equal the amount you invested in your policy.

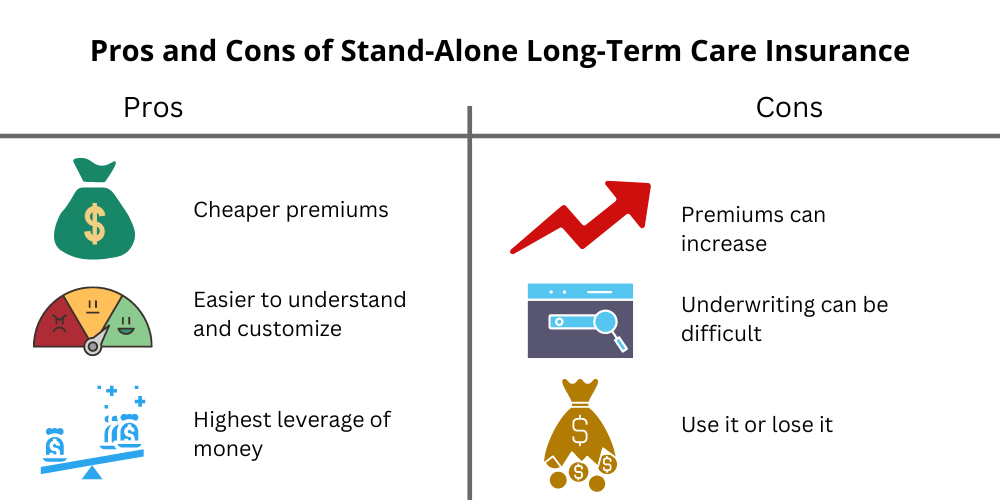

Whether you start at a low premium or not, your premiums can increase as you age. You may pay upfront to avoid the increases, but not everyone has the funds to do that.

Increased premiums can create unexpected expenses, and if you purchased the policy to lower your long-term costs, you might find that an increase is more of a setback. Long-term care insurance companies can also deny you from purchasing a policy at all.

If you’re over a certain age or have pre-existing health problems, there is a possibility that the insurance companies could decline you. Plus, the older you are when you purchase your policy, the higher your premiums.

Many companies deny people over the age of 70, as many people need long-term care starting in their 70s or 80s.

If you can’t afford to pay $4,000 or more per year for a policy starting at that age, long-term care insurance may not be available to you.

There are other components, but these encompass some of the most significant factors.

Believe it or not, the average long-term care insurance policy costs $2,700 per year for a couple at age 55.

The cost goes up as you get older. For example, if that same couple purchases a policy at age 60, their prices rise almost $1,000 to an annual average of $3,381.

That’s because as you age and your health worsens, insurance companies are less likely to approve you for a policy.

If you aren’t able to afford the $1.5 to $2 million required to cover up to $100,000 per month of long-term care expenses out of pocket, you’ll need long-term care insurance or an alternative.

If you’re a young adult, you might also consider buying long-term care insurance for your parents.

An insurance policy for your parents can offset much of the stress that comes with caring for elderly parents and paying for their care yourself.

However, sometimes you don’t need the extent of coverage that long-term care offers. In these cases, you have other options, some of which include:

The policy you choose, whether long-term care insurance or otherwise, depends on your circumstances and needs for long-term care.

When it comes to the pros and cons of long-term care insurance, consider your needs as you age.

If you want to use your savings for you and your family, you may not want to reserve it all for long-term care.

Consider your likelihood of needing long-term care, and plan accordingly. But in all honestly, there really is no reason to wait on getting covered, the sooner the better.

Just click here to get a few quotes and to get the process started.