As a twenty-something, it’s easy to procrastinate building financial security. With all the pressures of starting the journey toward independence, terms like investment strategy, diversified portfolio, and rate of return might sound exhaustingly complex. Moreover, you’re at the start of your career, and just getting by — earning enough to cover the basics — can be challenging enough.

You’re not alone — it’s completely normal to feel a little lost when discussing finance. Here to help: This guide on how to start investing in your 20s.

Why is it important to start investing early?

Imagine yourself as a 65-year-old at the end of a long and illustrious career. You’ve contributed to the economy and workplace, and now you’re ready to spend the golden years of your life traveling or spending time with family or finally taking up woodworking. (You’ve always imagined building Stonehenge with rich mahogany.)

However, you began contributing to your retirement plan quite late, and the balance is a little lighter than you like. You face a difficult choice: Retire anyway (and compromise on your dreams, or even risk some dire financial consequences), or continue working (and delay gratification, not to mention taking on added health risks).

In our example, if you began investing earlier, you’d have a much longer timeframe to build the nest egg you need to retire. Your investments would have time to increase in value over the years and decades.

Thus, investing young can help you to reach your investment goals over the course of your lifetime. Waiting makes your situation more precarious, and you might need to delay retiring in favor of letting your investments grow.

Considerations that will determine the best investment path

Not everyone follows the same investment strategy — nor should they. Everyone has different objectives and other aspects that impact how much they can invest and which asset classes are most suitable for them. Here are some considerations as you determine how to invest in your 20s.

Your financial goals

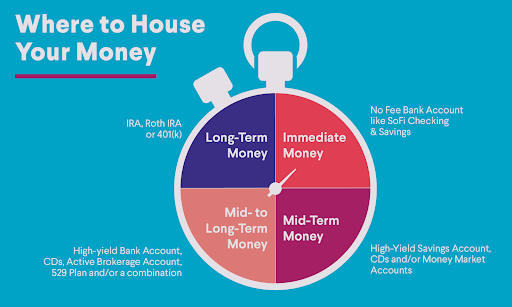

Start by defining what your short- and long-term goals are. Short-term goals include establishing an emergency fund or paying off credit card debt. A long-term goal is more substantial, like saving for a down payment on a home or retirement.

You can set several financial goals and develop investment plans to meet each. High-yield savings accounts can be an excellent option for building your savings. If retirement is your current concern, you can invest in your employer’s retirement plan.

Your risk tolerance

Most investment products don’t guarantee a return. For instance, if you invest in the stock market, it’s certainly possible you’ll lose money.

Other investments are less risky, but their earnings potential might not be as high. For instance, a certificate of deposit (CD) can guarantee you’ll earn a specific amount of interest, but the earnings might underperform against the stock market.

Your budget

Despite your best efforts, you might not be able to invest as much as you like. After all, living expenses like rent, groceries, and transportation come before your investments. Determine how much you can reasonably afford to invest each month and stick with it. You can always increase the amount you invest as your financial circumstances change.

5 types of investments to kick-start your journey

Some popular investments for people in their 20s include retirement plans, IRAs, mutual funds, and bonds. Here’s what to know about investing for young adults and the alternatives available.

Many organizations offer employer-sponsored retirement plans. You can use these to invest toward retirement. Retirement plans fall into two categories: defined benefit plans and defined contribution plans.

Defined benefit plans guarantee you a specific amount of money once you retire, which depends on your earnings and years of service. You usually don’t contribute to them. Instead, your employer assumes the risk of the payout. Military and other government service members might be eligible for defined benefit plans, but some civilian employers offer them, too.

Defined contribution plans are more common among public and private companies. They require the employee to contribute an amount of their choosing, usually a small percentage of their salary. Some employers will match the employee’s contributions up to a certain amount.

You can select between various investment funds available through the plan, and the value of your account will fluctuate depending on the market. Examples of defined contribution plans include 401(k)s.

Think of your employer-sponsored retirement plan as an introduction to investing. But you might also keep an open mind for other investment options to help you reach your financial goals.

2. Open an individual retirement account

An individual retirement account (IRA) is another retirement savings plan, but your employer doesn’t sponsor it. Instead, you’ll need to go through the administrative process yourself to establish the account. However, it’s very simple, and many major banks and other financial institutions offer IRAs you can easily open.

Any IRA contributions will go toward investments you select, such as equities or mutual funds. While you won’t benefit from an employer’s matching contribution, there are certain tax advantages, depending on your IRA type. For instance, you can deduct your contributions to a traditional IRA from your taxable income, which reduces your liability for the year. The Roth IRA also allows you to contribute after-tax dollars to your account, meaning you don’t pay taxes when withdrawing the funds in retirement.

Whether you simply want additional opportunities to save for retirement or you can’t access an employer-sponsored retirement plan, opening an IRA might make sense. Consider your tax situation and future retirement goals when deciding which suits you.

3. Secure a systematic investment plan in a mutual fund

A systematic investment plan in mutual funds is among the most popular investments for young adults establishing their financial footprint. Systematic investment plans (SIPs) don’t require active management. Instead, you make an initial investment that recurs over the long term, which goes toward purchasing shares in mutual funds.

You can invest as little as $5 a week in some SIPs. Others allow you to make monthly, quarterly, or annual investments for an amount of your choice. Every contribution you make purchases shares in the mutual fund, but your actual ownership will vary depending on the share’s value at the time of the contribution.

If you’re new to investing and want to get the hang of putting part of your earnings toward investments, an SIP might be a good option. Just note that some SIPs require a long-term commitment and will charge fees if you withdraw your money early.

4. Invest in government or corporate bonds

Bonds are suitable investments for well-diversified investment portfolios. They offer less volatility than stocks and can provide a reliable cash flow and steady rate of return.

Government bonds, like U.S. Treasury bonds, are available directly through the government. You can buy them for 20- or 30-year terms, during which they regularly incur interest. They don’t require a significant investment — some are available for as little as $25.

Another option is bond funds, which you can purchase through investment companies. Bond funds are typically exchange-traded funds (ETFs) or mutual funds with large portfolios of various bond investments. They’re quite accessible and don’t require significant upfront money to begin investing.

5. Spread your money across different types of assets

There’s no reason to stick with one specific investment option. Many alternatives include stocks, bonds, commodities, and real estate. You can start small with your retirement savings plan, then slowly add others as you learn more about their benefits and how they can benefit your investment goals. Diversifying your portfolio can also help protect your investments against market fluctuations.

If you’re unsure where to start, consider partnering with a financial advisor who can help you establish a monthly budget and an investment plan for your financial objectives. A qualified financial advisor can help you select good investments for young adults, determine the proper asset allocation for your risk tolerance, and set you on a positive path to financial success.

The role of life insurance

Investments are only one part of the financial equation. Life insurance is another. While you might not think you need life insurance in your 20s, a policy can make sense for many people, especially those with financial dependents like a spouse or a child.

With the death benefit from a life insurance policy, your beneficiaries can use the proceeds to pay for funeral expenses or take care of themselves should anything happen to you. You’ll leave a lasting financial legacy for your partner, children, or other loved ones. Start your journey toward peace of mind by getting a free online life insurance quote today.

Disclosure:

Haven Life Insurance Agency (Haven Life) does not provide tax, legal or investment advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or investment advice. You should consult your own tax, legal, and investment advisors before engaging in any transaction. [Individuals involved in the estate planning process should work with an estate planning team, including their own personal legal or tax counsel].