Are you wondering what flood insurance will actually cost you in Florida this year?

If so, you’re not alone. Florida leads the nation in flood insurance policies, but most online answers to “how much does flood insurance cost in Florida?” are vague, outdated, or based on national averages that don’t reflect the reality of your risk.

In this 2026 Florida Flood Insurance Pricing Guide, you’ll get real insight based on over 1,000 policies we’ve written statewide. You’ll learn why costs vary so widely, what to expect by region, and how to reduce your premium with the right strategy.

What you’ll find below:

- Key factors that determine your Florida flood insurance rate

- Regional pricing breakdowns for cities like Tampa, Naples, and Jacksonville

- FAQs on NFIP vs. private options, requirements, and ways to save

- Actionable next steps for securing a personalized quote fast

Why Flood Insurance Prices in Florida Vary So Much

There is no one-size-fits-all answer when it comes to flood insurance pricing in Florida. Your rate depends on the specific risk profile of your home, not just your zip code.

Here are the top factors that shape what you’ll pay in 2026:

| Factor | What It Means |

|---|---|

| Location | Homes near the coast or rivers, especially in cities like Tampa, Miami, and Fort Myers, carry higher risk and higher premiums than inland properties in places like Orlando or Gainesville. |

| Flood Zone | FEMA assigns flood zones like VE (highest risk), AE (high risk), and X (moderate or low risk). Your zone has a direct impact on cost. |

| Elevation | Homes elevated above the Base Flood Elevation (BFE) typically see much lower premiums. An elevation certificate can document this. |

| Building Characteristics | The age, construction type, number of floors, and foundation type all influence how much risk your home carries. Newer homes often qualify for better rates. |

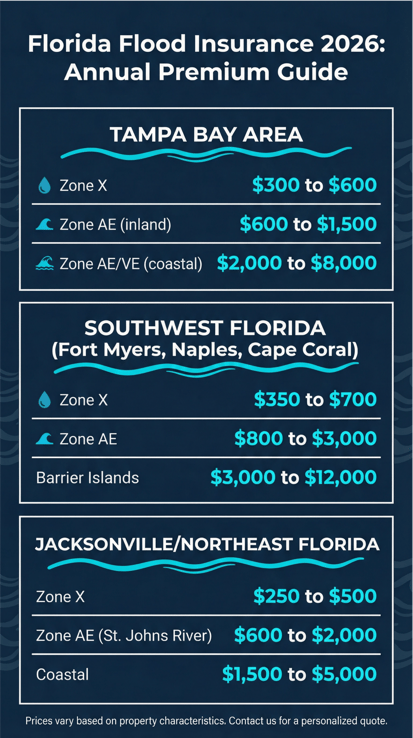

Real Florida Flood Insurance Prices by Region

To help you get a clearer sense of your potential cost, here’s a regional breakdown of typical 2026 flood insurance premiums:

Keep in mind: Two homes in the same city can have drastically different premiums depending on their elevation, distance from water, and foundation type.

Frequently Asked Questions

Is flood insurance required in Florida?

Yes, if you have a federally backed mortgage and live in a high-risk flood zone (Zones A or V), flood insurance is required. Even if you’re in Zone X, coverage is strongly recommended due to Florida’s unpredictable weather.

What is the difference between NFIP and private flood insurance?

The NFIP is managed by FEMA and offers standard coverage limits. Private insurers may provide higher coverage, added benefits like loss of use, and sometimes better rates depending on your property.

How can I lower my flood insurance cost?

You can potentially reduce your premium by getting an elevation certificate, installing flood vents, increasing your deductible, or choosing private coverage if it offers a better rate.

Does my homeowners policy cover flood damage?

No. Flood damage is not included in a standard homeowners policy. Flood insurance must be purchased separately through NFIP or private carriers.

Protecting Your Florida Property Starts with a Personalized Quote

Flood insurance in Florida is complex. With variables like flood zones, elevation, and proximity to water, there’s no way to guess your cost without looking at your specific property.

Now that you understand the major cost drivers and the wide premium ranges across different regions, you are equipped to make an informed decision. Whether you’re on the Gulf Coast or inland in Gainesville, the best way to protect your home and stay compliant is to get a custom quote.

At Flood Insurance Guru, we believe education builds trust, and that trust grows into confident long-term protection. Click below to download your Free 2026 Florida Flood Insurance Guide.

\