U.S. homeowners’ insurance is in position to improve in 2024, according Fitch Ratings.

The rating agency said premium revenue growth, tied to recent substantial price increases and more diligent underwriting to manage risk concentrations and aggregations, points to improvement in 2024 underlying segment results.

“However, carriers may continue to struggle to generate underwriting gains depending on catastrophe loss experience, and results will vary considerably,” added Fitch.

Fitch reported that industry written premium growth is anticipated to exceed 12% in 2024 as carriers continue to take substantial pricing and underwriting actions to return to rate adequacy and improve performance. In fourth-quarter earnings disclosures, Travelers Corp. reported a renewal premium change of 21% in homeowners, while Hartford Financial reported a renewal written price increase of 15%.

“Economic inflation has moderated, but insurers continue to face loss cost uncertainty from cost volatility and lack of availability of key building materials and components and skilled labor, as well as higher reinsurance costs,” the Fitch article said. “Amid potential for more frequent large convective storm events, underwriters are more diligently managing risk concentrations and aggregations across all geographic regions.”

Revisiting 2023

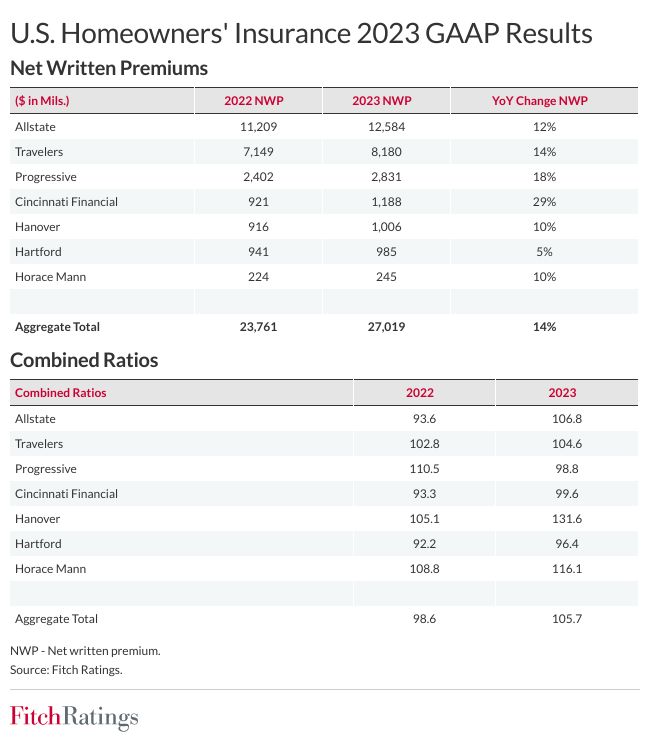

Those predictions come after an analysis seven publicly held homeowners insurers revealed 14% growth in net written premiums in aggregate and a seven-point combined ratio increase to 105.7.

The Allstate Corporation, the second-largest U.S. homeowners writer, reported a combined ratio of 106.8 in 2023. Allstate’s combined ratio was listed at 93.6 in 2022.

Fitch also highlighted variability in results due to differences in catastrophe-related incurred losses. The Hanover Insurance Group reported a 131.6 homeowners 2023 combined ratio, while the Progressive Corporation dropped below 100 combined ratio in 2023, due, in part, to fewer Florida insured losses.

The property and casualty insurance industry is anticipated to post deterioration in homeowners’ statutory underwriting performance for the year, with a segment combined ratio projected at 109 in 2023 versus 104.4 in 2022, Fitch said.

Full-year 2023 statutory homeowners combined ratios are not yet available, but significant increases in direct loss ratios for the first nine months of the year indicate “significant deterioration in homeowners results for the largest mutual insurers in the segment, including State Farm, USAA, Liberty Mutual and American Family,” Fitch reported. The industry direct loss ratio rose by five points year-over-year to 82 at the end of September 2023.

Topics

Carriers

Homeowners

Interested in Carriers?

Get automatic alerts for this topic.