Published on March 7, 2024

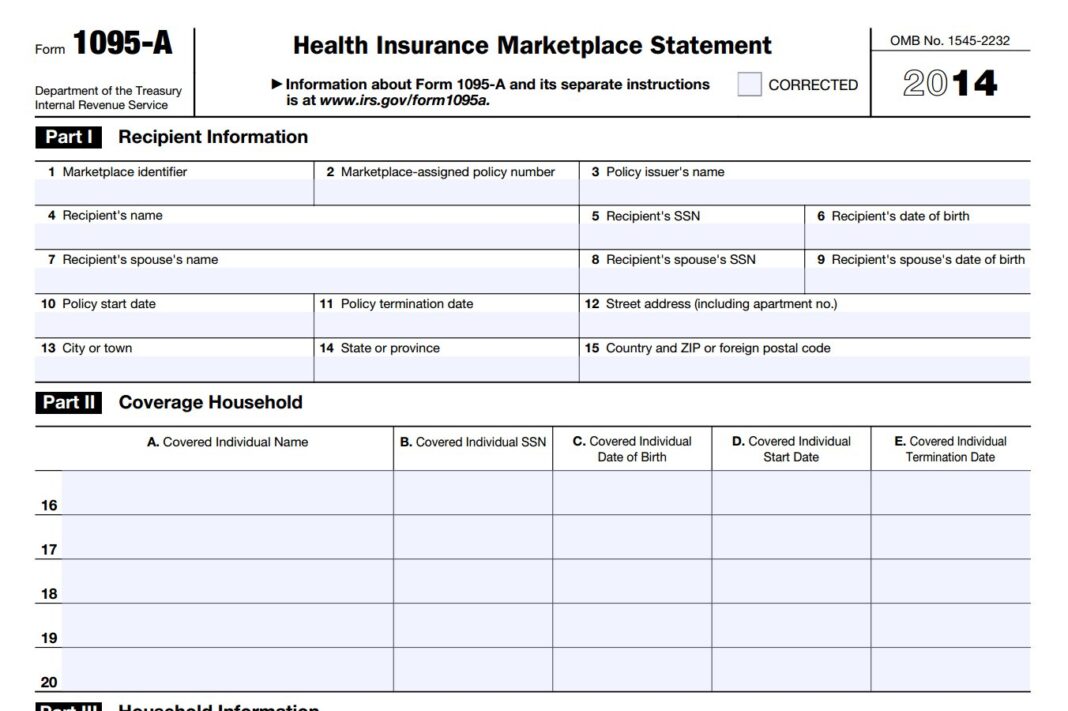

The tax filing deadline is April 15, 2024. If anyone in your household had a Marketplace plan in 2023, use Form 1095-A, Health Insurance Marketplace®, to file your federal taxes. You’ll get this form from the Marketplace, not the IRS.

It’s important to review your Form 1095-A and reconcile your premium tax credit because it could impact your refund or the amount of taxes you owe.

Check your online account for Form 1095-A

- Under “Your Existing Applications,” select your 2023 application.

- Select “Tax Forms” from the menu on the left.

- Download all 1095-A forms shown on the screen.

“Reconcile” using Form 1095-A

If you (or anyone in your household) qualified for or used the premium tax credit to lower your Marketplace plan premium: