What You Need to Know

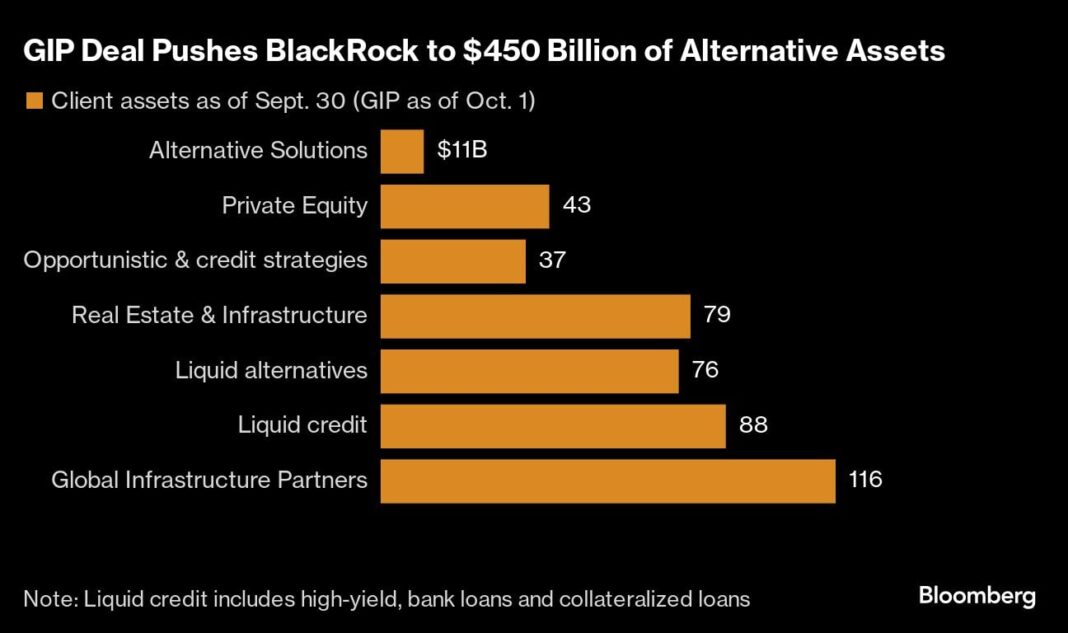

- The closing of the firm’s $12.5 billion acquisition of Global Infrastructure Partners adds $116 billion in assets to the firm.

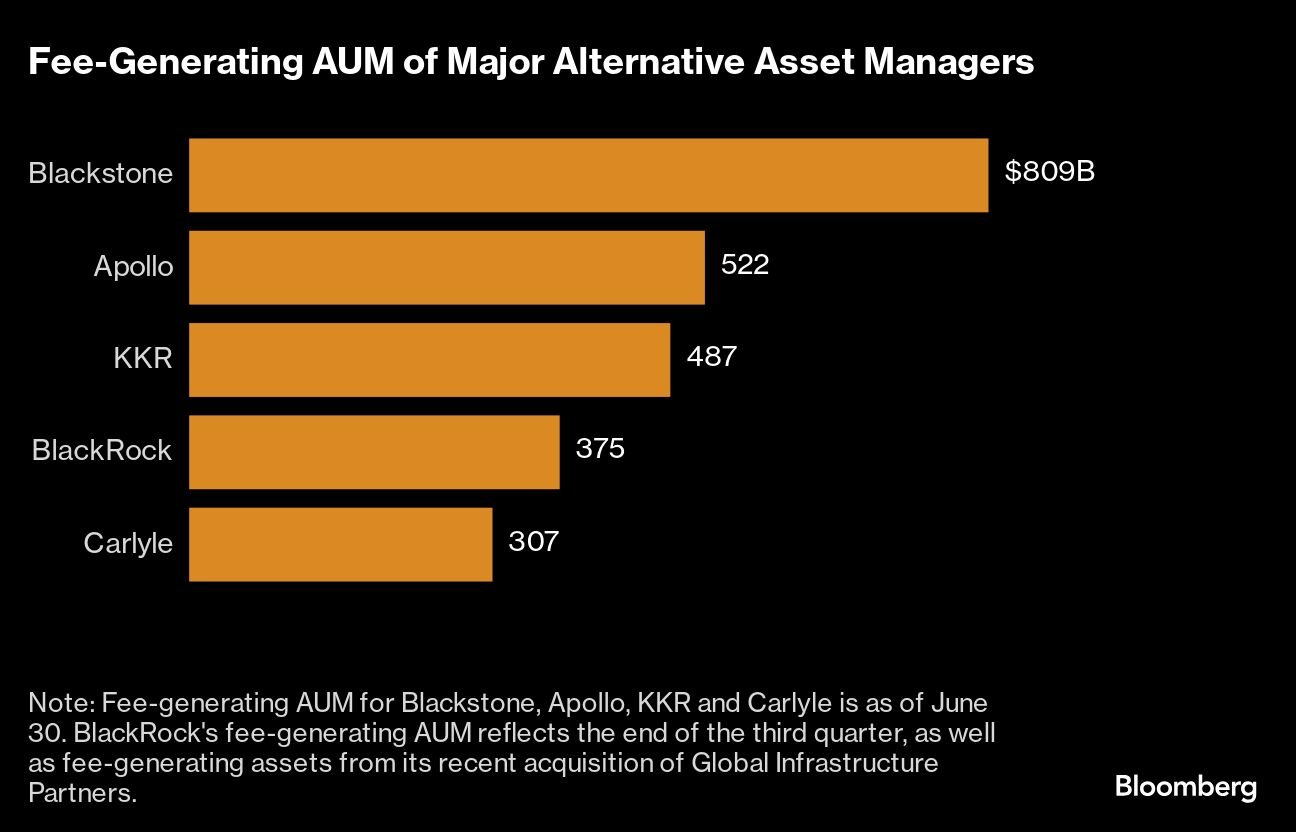

- With the boost from GIP, BlackRock’s alternative assets tally now puts it closer to industry leaders like Blackstone, Apollo and KKR.

- BlackRock also is sitting on a $70 billion opportunity to grow in private credit if it flipped just 10% of its insurance clients’ money.

BlackRock Inc. reaching $450 billion in alternative assets is putting a finer point on a case it has been making all year: it’s not just an ETF powerhouse.

The closing of the firm’s $12.5 billion acquisition of Global Infrastructure Partners adds $116 billion in assets to the $334 billion that the firm managed at the end of September in real estate, private equity, hedge funds and illiquid infrastructure, as well as liquid credit funds.

With the boost from GIP, BlackRock’s alternative assets tally now puts it closer to industry leaders like Blackstone Inc., Apollo Global Management Inc. and KKR & Co.

BlackRock’s $375 billion in fee-paying alternative assets ranks above Carlyle Group Inc.’s $307 billion at the end of the second quarter. The four alternative investment firms have yet to report third-quarter earnings.

BlackRock has expanded aggressively over the past year into alternative assets, in an effort to transform the world’s largest asset manager into a one-stop shop for stocks, bonds and private strategies, as well as financial consulting for strategic and governmental clients.

Private assets and liquid alternative hedge funds are still a small fraction of the firm’s total $11.5 trillion in assets and $4.2 trillion in exchange-traded funds, but they typically charge higher fees, boosting revenue and profits for the firm.

“Private markets are a strategic priority for BlackRock,” Chief Financial Officer Martin Small told analysts after the world’s largest asset manager reported third quarter earnings.

The GIP acquisition is the company’s biggest in about 15 years, vaulting the money manager to become the second-largest infrastructure manager in the world.

Private assets are more lucrative than low-cost index funds, and GIP is expected to add $250 million in management fees in the fourth quarter, Small said.

BlackRock is also in the process of closing a £2.55 billion ($3.1 billion) acquisition of private-markets data firm Preqin, which the company said will usher in a new era of retail investment opportunities by allowing it to index private markets.