Aviva Plc agreed to buy Direct Line Insurance Group Plc for roughly £3.7 billion ($4.65 billion) in a deal that would create the UK’s largest motor insurer.Each Direct Line shareholder will be entitled to receive 0.2867 new Aviva shares, 129.7 pence in cash and as much as 5 pence in dividend, according to a statement on Monday. The transaction would value each Direct Line share at 275 pence apiece, representing a premium of about 73% to the closing price on Nov. 27, when Bloomberg News first reported the takeover interest.

The board of Direct Line considers the terms to be “fair and reasonable” and intends to recommend unanimously that its shareholders vote in favor of the takeover, according to the statement. Upon completion, which is expected around mid-2025 subject to conditions and approvals, Aviva will hold roughly 87.5% of Direct Line.

The deal “delivers significant value” and “reflects the attractiveness of Direct Line,” Danuta Gray, the target’s chair said in the statement.

Direct Line shares jumped as much as 3.6% in early London trading on Monday, extending their gains to about 58% since the initial Nov. 27 report on Aviva’s pursuit, when they closed at 158.70 pence. Aviva shares have declined about 6.6% in the same period.

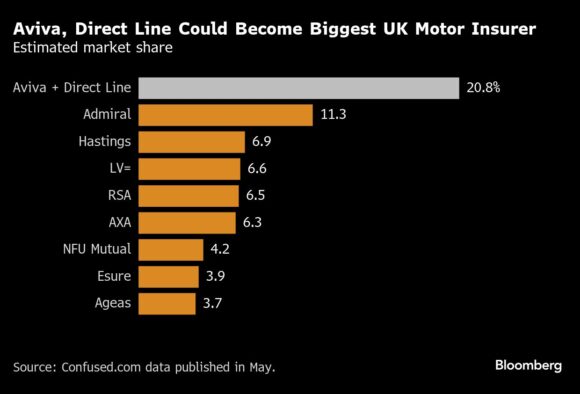

Combined, Direct Line and Aviva would become the UK’s largest motor insurer, catapulting past their larger competitor Admiral. Bloomberg Intelligence has said previously that the deal would double Aviva’s share in that market. The deal is not expected to impact Aviva’s credit ratings and the company said it expects “centre liquidity” to remain above £1 billion.

Aviva started hunting for acquisitions again after Chief Executive Officer Amanda Blanc pursued a series of divestments that slimmed down the insurer and left it more focused on the UK. In March, Aviva said it was entering the Lloyd’s insurance market through a £242 million purchase of Probitas.

Last year, it agreed to buy Corebridge Financial Inc.’s UK protection business AIG Life Ltd. for £460 million. Aviva is among potential suitors that have been studying Esure Group Plc, the British home and motor insurance firm backed by Bain Capital, Bloomberg News has reported.

Direct Line has been pursuing an independent path after rebuffing a proposal from Belgian rival Ageas in March that valued it at around £3.2 billion. It said last month it’s going to cut about 550 jobs as part of a turnaround plan aimed at saving £50 million next year.

“We think the likelihood of a competing offer is low,” MKP Advisors wrote in a note on Monday, citing the significant premium, board recommendation and synergies. The focus will now shift to the antitrust review in the UK by the CMA, “but ultimately this one should face a pretty straightforward path to completion” because motor and home insurance markets remain “deeply fragmented.”

Bromley, England-based Direct Line sells insurance under its eponymous brand as well as through units including Churchill, Green Flag, Privilege and Darwin Motor Insurance. In addition to car insurance, it also offers home, travel, pet and life insurance as well as offering cover for businesses.

Dealmaking has been picking up in the UK, with the volume of mergers and acquisitions targeting British companies up about 80% this year to $177 billion, data compiled by Bloomberg show. British companies are attracting interest despite fears that Prime Minister Keir Starmer’s new government would lead to higher taxes and an exodus of the wealthy.

Citigroup Inc. and Goldman Sachs Group Inc. advised Aviva on the deal while Direct Line worked with Morgan Stanley, Robey Warshaw and Royal Bank of Canada. Goldman’s role with the buyer drew some attention because the New York-based bank had previously advised Direct Line on its defense against Ageas earlier in the year.

Photograph: The Direct Line Insurance Group Plc app. Photo credit: Jose Sarmento Matos/Bloomberg

Related:

Copyright 2024 Bloomberg.

Topics Mergers & Acquisitions Carriers

Was this article valuable?

Here are more articles you may enjoy.

Interested in Carriers?

Get automatic alerts for this topic.