The above is the title of a helpful primer from Kenney and Keast (2024). I summarize some key points below.

Provide an overview of the pharmacy contracts between stakeholders in the healthcare ecosystem.

How did the rise of health maintenance organizations (HMOs) impact pharmacy contracting?

The Health Maintenance Organization (HMO) Act of1973 spurred the growth of comprehensive health plans, such as Kaiser Foundation Health Plan, Group Health Cooperative of Puget Sound, and Health Insurance Plan of Greater New York. 3 It also required employers who offered insurance and had 25 or more employees to offer a federally qualified HMO if available in their market, which led to further expansion of HMO plans

Interesting points, but how are HMOs related to pharmacy contracts now?

Although pharmacy was not a standard part of benefits in the early HMO programs…some plans offered prescription drug coverage as an additional benefit to attract members. HMOs that provided drug cover-age adopted formulary programs patterned after the hospital systems and created preferred drug lists with tiered copayments.

How are discounts incorporated in practice?

The table below summaries these calculations where Brand A is a high cost but high rebate product and Brand B is a low-cost but low rebate product.

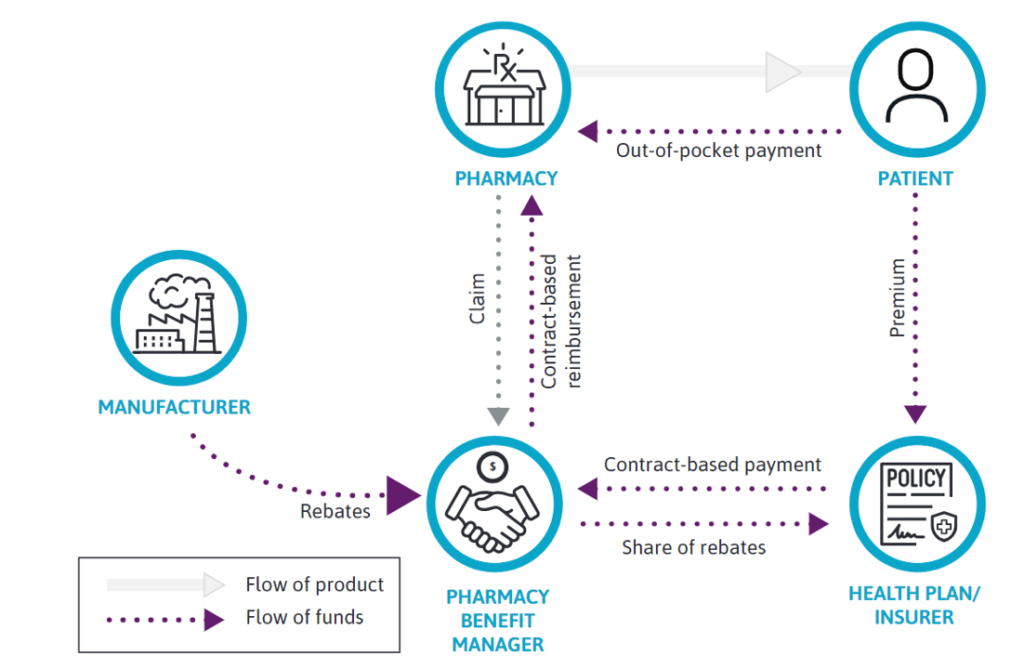

The net price calculation starts with the contracted reimbursement amount between the PBM and the pharmacy, in which the reimbursement amount is typically a percentage of the wholesale acquisition cost (WAC). Next, any out-of-pocket cost (copay, coinsurance, or deductible) paid by the health plan member is subtracted. Finally, any rebates paid by the manufacturer to the PBM are subtracted to arrive at the net price paid by the PBM.

What types of contracts are there?

- Purchase Discount Agreements. This agreement is a negotiated contracted for a drug that health plans pay when they purchase directly from the manufacturer as compared to through a PBM. If a wholesaler is used, the wholesalers use a “chargeback method” where the manufacturer authorizes the wholesaler to sell the product to the health plan at the contract price and the wholesaler simply charges back the manufacturer the difference between the WAC price and the contract along with an administrative fee.

- Rebates. A rebate is a retroactive discount manufacturers provide to PBMs after a drug has been purchased and dispensed. In this process, the manufacturer pay a percentage of the drug price (the rebate) back to the PBM and the PBMs share all or a portion of rebates with health plans. Types of rebate agreements include an access agreement (rebate based on any formulary placement), a market share rebate (rebate based on market share or volume), or preferred formulary status agreement (rebate based on formulary tier).

- Value-based contracts. The payment for the drug depends on the “value” of the product. Value could include specific patient outcomes, whether patients are adherent to the medication, CMS’s Cell and Gene Therapy Models use value-based contracts.

You can read the full article including a discussion of Medicaid best price here.