Are your monthly mortgage payments increasing and you are not sure why?

For many Alabama homeowners, the answer is hidden inside the escrow account. Rising flood insurance premiums from FEMA are quietly inflating payments month after month.

In this article, we will show you how homeowners across Mobile, Baldwin, and beyond are cutting $100 or more from their monthly mortgage just by switching from FEMA to private flood insurance. You will learn the exact math, how to get immediate relief without refinancing, and how to handle the FEMA refund check the right way.

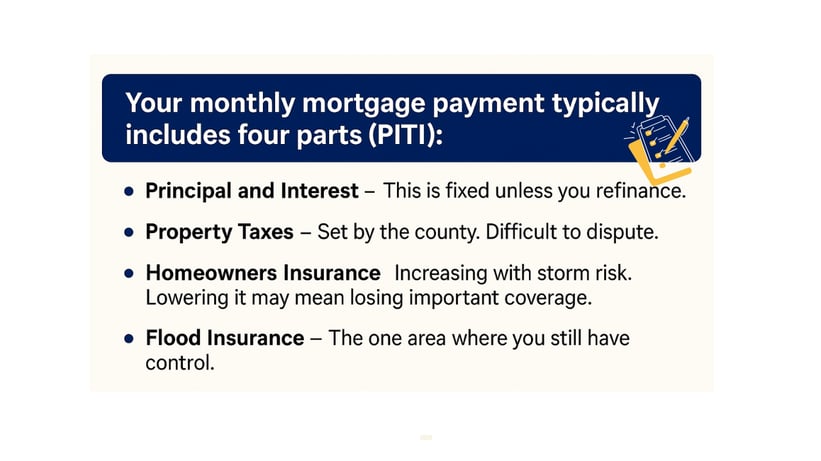

The One Part of Your Mortgage You Can Actually Control:

If you are insured through FEMA’s National Flood Insurance Program (NFIP), you are likely paying a government-set premium under Risk Rating 2.0. These rates are climbing each year.

You can shop for Private Flood Insurance, which is accepted by nearly all lenders and often provides better rates and broader protection.

$125 Monthly Mortgage Reduction Without Refinancing

Here is a real case from a homeowner in Mobile County with a mortgage at First Bank. Their monthly flood insurance escrow was $200.

| Cost Category | FEMA (NFIP) | Private (Through Us) | Your Savings |

|---|---|---|---|

| Annual Premium | $2,400 | $900 | $1,500 per year saved |

| Monthly Escrow Payment | $200 | $75 | $125 saved per month |

With one switch, this family saved $1,500 a year, or $125 every month, without refinancing or reducing coverage.

How to Trigger a Mortgage Payment Drop Now

Here is the four-step process to reduce your payment immediately:

1. Switch to Private Flood Insurance

We help you select a compliant, lower-cost policy from trusted carriers like Hiscox or Dual.

2. Receive a Refund Check from FEMA

Once we cancel your FEMA policy, they will send you a refund check for the unused premium.

3. Apply the Refund to Your Escrow

Instead of spending it, walk that check into your bank and ask them to apply it toward your escrow balance.

4. Request an Off-Cycle Escrow Review

This triggers a recalculation of your monthly mortgage right away, instead of waiting for the next escrow analysis.

Mortgage + Flood Insurance FAQ

Can switching flood insurance really lower my mortgage payment?

Yes. Flood premiums are part of your escrow. Lowering that premium reduces your monthly payment directly.

Will my bank accept private flood insurance?

Yes. As long as the policy meets federal standards, banks like First Bank, First Federal, and Bank of England will accept it. We make sure every policy we issue is compliant.

Do I need to wait for renewal to switch from FEMA?

No. You can switch any time and receive a prorated refund from FEMA under Cancellation Reason Code 26.

How fast can my mortgage drop?

If you apply the refund and request an off-cycle review, your monthly payment can drop within a few weeks.

The Smartest Way to Lower Your Mortgage Without Refinancing

Flood insurance is the only part of your mortgage you can reduce right now. If FEMA premiums have pushed your mortgage payment higher, now is the time to act.

By switching to private flood insurance, Alabama homeowners are saving $1,000 to $2,000 per year without cutting corners on coverage.

Click below to access our free Alabama Flood Insurance Guide and let us help you compare your current policy to better options.