Are You Overpaying for Flood Insurance Because of a Walkout Basement?

If you own a home in Hoover, Alabama, especially in neighborhoods like Riverchase, Greystone, or Lake Cyrus, a finished basement is a huge value add. It might be your home gym, media room, or the ultimate hangout space. But when your flood insurance bill arrives, that lower-level space can become a hidden liability.

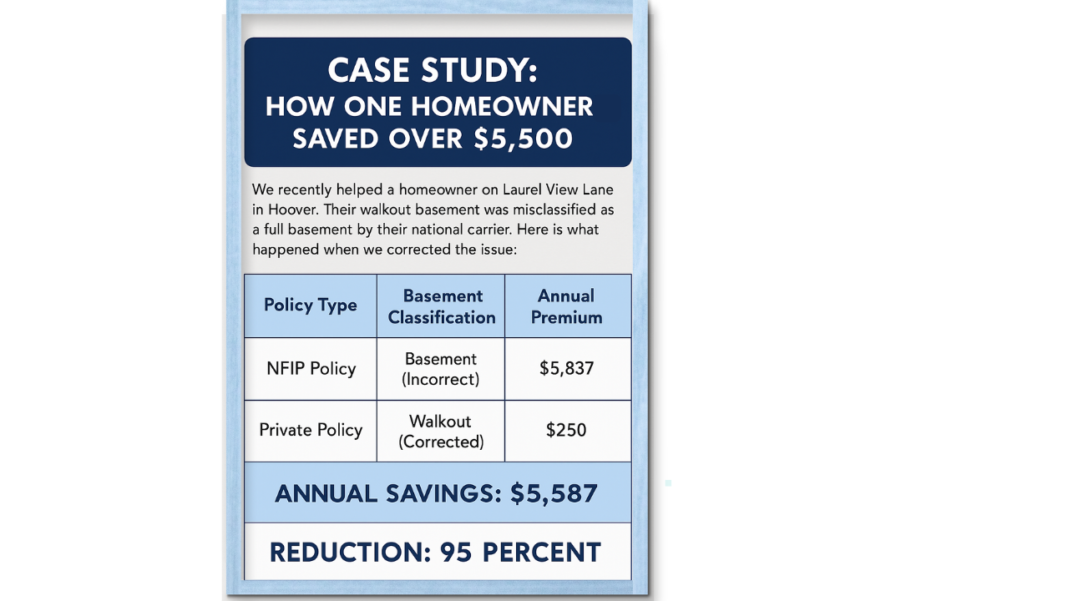

In many ZIP codes like 35244 and 35226, homeowners are unknowingly paying what we call the “Basement Tax,” an inflated flood premium caused by a simple classification error.

The good news? There is a solution that could cut your cost by over 90 percent.

FEMA’s “Lowest Floor” Rule

The National Flood Insurance Program (NFIP) rates your home based on your lowest finished floor. If that floor is below ground on all sides, FEMA treats it as a flood risk, even if your home is on a slope or hill.

This outdated rule penalizes homeowners in places like Hoover, where walkout basements are common due to rolling terrain.

Unfortunately, many insurance agents misclassify walkout basements as true basements, and that mistake can cost you thousands each year.

Walkout Basements Are Not Basements, If You Know the Rules

FEMA defines a basement as any level that is below ground on all sides. But a walkout basement has one or more walls at ground level with an exterior door.

Private flood insurance carriers see this distinction more clearly. Many classify a walkout as a first floor, not a basement. That reduces the perceived flood risk and often slashes your premium.

How to Fix the Problem and Lower Your Premium

You do not need to remodel or renovate. You need proper documentation:

-

An accurate Elevation Certificate (EC)

-

Property photos that show the walkout design

-

A professional review by a flood insurance expert

At The Flood Insurance Guru, we specialize in identifying and correcting misclassified walkout basements. We work with carriers like Neptune, Wright, and Lloyd’s of London to find policies that reflect your actual flood risk, not an outdated definition.

Frequently Asked Questions

What’s the difference between a basement and a walkout basement for flood insurance?

A basement is below ground on all sides. A walkout basement has at least one wall at or above ground level with an exterior door. Private insurers often classify walkouts as the first floor.

How can I tell if I am overpaying for flood insurance?

If you have a walkout basement and your policy is with the NFIP, there is a good chance you are overpaying. A review of your classification and elevation certificate will confirm it.

What is an Elevation Certificate and why do I need one?

An EC shows your home’s elevation relative to flood levels. It helps insurers understand your actual risk and properly rate your policy. It is essential if you want to fix a walkout classification error.

Can I switch from FEMA to a private flood insurance provider?

Yes. In most cases, you can switch at any time. Private carriers often offer better rates and more flexible coverage, especially for homes with walkout basements.

Stop Paying the “Basement Tax”

If your Hoover home has a walkout basement and your flood insurance is still with the NFIP, you may be paying for a flood risk you do not actually have. This is not just a one-time mistake, it is a hidden monthly and annual cost that adds up quickly.

At The Flood Insurance Guru, we help homeowners fix misclassifications, get accurate flood risk assessments, and save hundreds or thousands every year. Whether you live in Greystone, Trace Crossings, or anywhere in Jefferson or Shelby County, our team is ready to help.