If you’re a Connecticut homeowner exploring alternatives to the National Flood Insurance Program (NFIP), you may be wondering whether your lender will accept private flood insurance. The good news is that federal law is on your side, if your policy meets certain requirements, lenders must accept it. In this article, you’ll learn how private flood insurance works in Connecticut, what makes a policy compliant, and how to maximize your protection while potentially saving money.

The Legal Framework: Biggert-Waters Flood Insurance Reform Act of 2012

Understanding the acceptance of private flood insurance by lenders in Connecticut begins with the Biggert-Waters Flood Insurance Reform Act of 2012. This pivotal legislation was designed to reform the National Flood Insurance Program (NFIP) and encourage the growth of the private flood insurance market. Prior to this act, the acceptance of private flood insurance by lenders was a gray area, often leading to the default reliance on the NFIP. The Biggert-Waters Act mandated federal lending regulators to ensure that private flood insurance policies are accepted, provided they meet certain criteria.

This act aimed to create a competitive environment where private insurers can offer flood policies with better coverage and higher limits at lower premiums. For Connecticut homeowners, this means more options and potentially significant savings.

How the 2019 Final Rule Impacts Connecticut Homeowners

In 2019, five federal agencies, including the FDIC and the Federal Reserve, issued a final rule that clarified the terms under which private flood insurance must be accepted by federally regulated lenders. This rule enforces that all regulated lending institutions must accept private flood insurance policies that meet the statutory definition of “private flood insurance.”

This is a major benefit for Connecticut homeowners, as it ensures that lenders, from large national banks to small credit unions, cannot legally reject a valid private flood insurance policy. The rule removes the uncertainty and ensures that homeowners can opt for private flood insurance without fearing lender rejection, provided the policy meets federal standards.

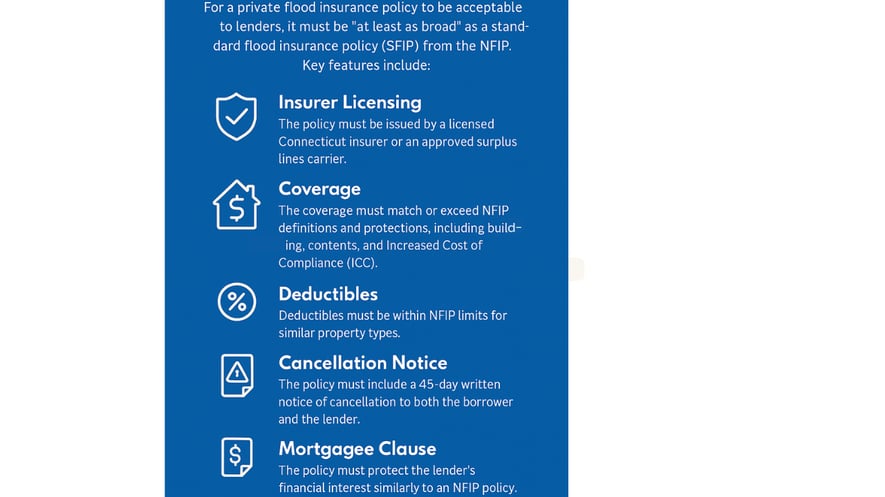

Key Features of an Acceptable Private Flood Insurance Policy

Steps to Ensure Your Private Flood Insurance Is Accepted by Lenders

To ensure your private flood insurance policy is accepted by your lender:

-

Check for the Compliance Aid Statement: Ensure your policy includes the statement: “This policy meets the definition of private flood insurance contained in 42 U.S.C. 4012a(b)(7) and the corresponding regulation.”

-

Provide Documentation: If your lender is hesitant, share the OCC Bulletin 2019-8 and other relevant materials.

-

Escalate if Necessary: Ask to speak with a supervisor or someone in the compliance department.

-

Engage Your Insurance Agent: A knowledgeable agent can help you meet all requirements and communicate directly with your lender.

Refusing a compliant private flood insurance policy is a violation of federal law, so persistence and proper documentation are key.

Comparing Private Flood Insurance to the NFIP

While the NFIP has been the default option for many homeowners, private flood insurance often offers significant advantages:

-

Higher Coverage Limits: Private insurers can offer higher limits, which is essential for high-value properties.

-

Better Customization: Tailor your policy to meet your specific needs.

-

Lower Premiums: Many private policies are more cost-effective than the NFIP.

-

Faster Claims Handling: Private insurers often provide quicker and more efficient claims service.

Maximizing Protection and Savings with Private Flood Insurance

For Connecticut homeowners, the benefits of private flood insurance are clear. Choosing a compliant policy means you can enjoy superior coverage and financial savings. To maximize your benefits:

-

Obtain an Elevation Certificate: This can lower premiums by demonstrating favorable elevation data.

-

Elevate Your Home: Raising your home above base flood elevation reduces flood risk and premiums.

-

Install Flood Vents and Raise Utilities: These features help mitigate damage and can lead to lower costs.

-

Choose a Higher Deductible: This can lower your premium, but be sure it complies with NFIP standards.

Frequently Asked Questions

Are lenders in Connecticut required to accept private flood insurance?

Yes, as long as the policy meets the statutory definition of private flood insurance and includes required provisions, lenders must accept it.

What is the Compliance Aid Statement?

It is a federally approved clause that confirms the policy meets the legal definition of private flood insurance. Including it ensures lender acceptance.

How can I make sure my private flood policy is accepted?

Work with a knowledgeable agent, confirm the policy includes the Compliance Aid Statement, and provide your lender with supporting documentation.

Is private flood insurance more affordable than the NFIP?

Often yes, especially for high-value homes. It also allows for more flexible and comprehensive coverage options.

Can my lender refuse a private policy with the Compliance Aid Statement?

No. If the policy meets all legal standards and includes the statement, refusal would violate federal law.

Move Forward With Confidence

The flood insurance landscape in Connecticut has evolved. Thanks to federal laws and clarified guidelines, you now have more control and better options. At Flood Insurance Guru, we are committed to helping you navigate these choices confidently and compliantly. If you are ready to explore private flood insurance that meets your lender’s requirements and provides stronger protection, reach out to our team for a quote and guidance today.