As an insurance agent or broker, you play a critical role in helping your small business clients prepare for the risks associated with extreme spring weather. In this article, we’ll provide spring weather safety tips to help your small business clients prepare for and minimize the risks associated with extreme weather.

It’s important to start by understanding the types of spring weather events that can cause damage to businesses. Tornadoes, severe thunderstorms, flooding, blizzards, and excessive heat are some of the most common weather events that can cause significant property damage, injuries, and fatalities. Encourage your clients to stay informed about weather forecasts and warnings to ensure they are prepared to take necessary actions.

Plan Ahead

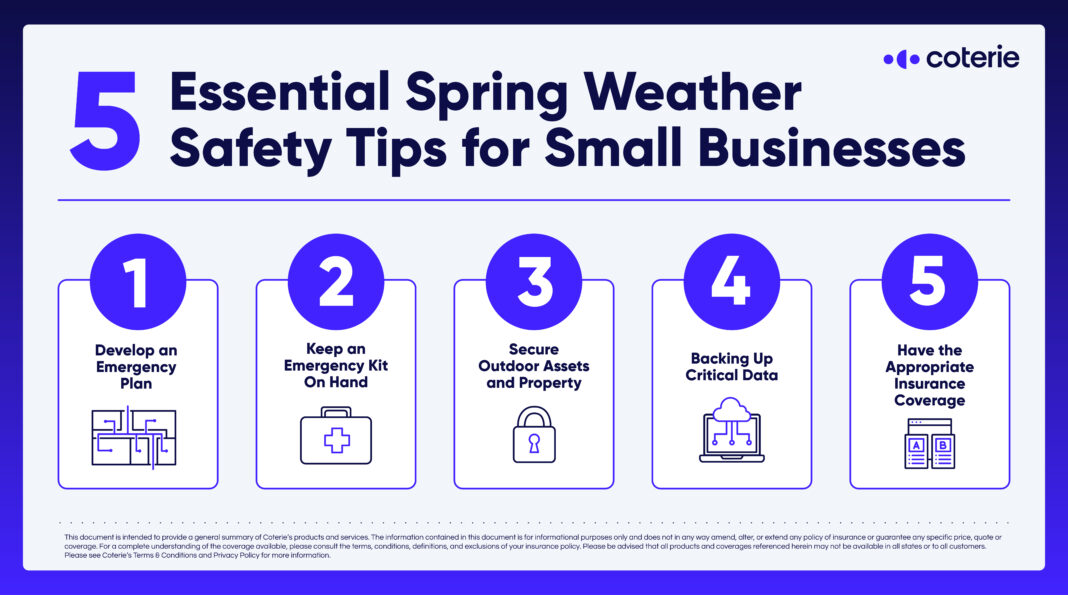

One of the most important steps that small businesses can take is to develop an emergency plan. This plan should outline what employees should do in different situations, such as power outages or evacuation orders. Encourage your clients to conduct regular drills to ensure everyone is familiar with the plan and to have a communication protocol in place to keep everyone informed and safe.

Another essential precaution is to keep an emergency kit on hand. This kit should include supplies like flashlights, water, a first-aid kit, blankets, extra batteries, a toolset, and contact information for local authorities.

To minimize property damage, encourage your clients to secure outdoor assets and property. This includes ensuring that dead trees are removed, structures are reinforced, and outdoor furniture is secured or brought indoors. Regular preventive maintenance can also help to identify potential hazards and fix them before they cause damage.

Backing up critical data is another important step in preparing for spring weather. This can help businesses to rebuild systems more easily after severe weather damages equipment or causes power outages.

Share our essential spring weather safety tips with your small business clients:

Make Sure Your Small Business Clients Are Covered

Lastly, ensuring that your clients have the appropriate insurance coverage in place is crucial. As their insurance agent or broker, help them understand and plan for the impacts of catastrophic weather events. Review their insurance coverage to identify any gaps that could leave them with an uncovered loss.

You can play a critical role in helping small businesses prepare for spring weather. Encourage your clients to develop an emergency plan, keep an emergency kit on hand, secure property and outdoor assets, back up data, and obtain appropriate insurance coverage to mitigate risks during the springtime better. Contact Coterie Insurance today for more information on how we can help you and your clients prepare for the unexpected.