Navigating how to track your Erie auto insurance claim becomes simple with multiple program offerings designed to keep you informed and in control of your claim’s progress.

Whether you’re checking through their app, calling the 24/7 support line, or reaching out to your agent, Erie gives you real-time updates on your claim’s progress. Most claims finish in about 12 days, so you can know what is happening without waiting a long time.

With tools like the mobile app and 24/7 support, keeping track of your claim is simple and easy, allowing you to pay attention to essential things. For more insights, check out our Erie auto insurance review to see how it stands out in service. Start comparing total coverage auto insurance rates by entering your ZIP code.

How to Track Your Erie Auto Insurance Claim

5 Steps on How to Track Your Erie Auto Insurance Claim

Tracking your Erie auto insurance claim is simple with the company’s mobile app, customer support, and online portal.

Step #1: Contact Your Agent

Give your local Erie agent a quick call for an update on your claim. They can walk you through the details and provide personalized assistance since they know what your auto insurance policy looks like. They can also address any specific questions you might have.

Ways to Track Your Erie Auto Insurance Claim

It’s a simple way to get the latest on your claim status, and they’re there to help guide you through anything that might come up. Plus, having someone familiar on the other end of the line can make the whole process more accessible and personal.

Step #2: Call Erie’s Customer Support

Call Erie’s 24/7 support line at 800-367-3743 if you need answers quickly. It is open 24/7, so help is available whenever needed—great for sudden problems or late-night questions. Their representatives are prepared to help you whether you need a brief update, have questions about the claims process, or want to discuss the cheapest auto insurance companies available.

Just have your claim number or policy details handy to speed things up. This option is great if you’re the type who prefers a natural person to chat with anytime, day or night, and they can explain any questions you have about.

Step #3: Use the Erie Mobile App

Log into the Erie mobile app for on-the-go updates and to understand how auto insurance works. It is a straightforward way to see your claim status without needing a phone call. With just some touches, you can follow where your claim is in process, look at policy details, and manage payments.

The app is useful if you have a busy schedule or like to manage things on your phone. Also, you can check your coverage details anytime—no waiting on hold or going to an office needed.

Step #4: Check Online

Erie’s online account is perfect if you like to use the computer for things. You log in to their website and find out updates about your claim. Sign in on their website to see how your auto insurance claim is doing and get the newest information. You can follow what’s happening with your claim, look at policy details, check billing, and even pay—everything is together for you.

It’s a straightforward way to keep up with everything, especially if you prefer a bigger screen or need to print documents. The online portal is also perfect if you must upload additional info to support your claim.

Average Auto Insurance Claims Length by Provider

Auto insurance claim times vary depending on the provider. USAA is the fastest, wrapping up claims in about nine days, with Geico close behind at 10 days. Erie keeps things moving, too, averaging around 12 days. Allstate may take a bit longer, usually around 18 days. Find more ways to check the status of an auto insurance claim.

Step #5: Chat with Customer Care

For quick help in the week, Erie offers an online chat service. The chat on their website is open from Monday to Friday, 8 a.m. to 10 p.m. EST, making it simple to get fast answers or support without calling them directly.

It’s also beneficial to know about different kinds of auto insurance coverage if you have questions while doing other things or need quick answers. During business hours, a person will help you with everything you require, including policy inquiries and claim updates.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

What Happens After You File a Claim With Erie

After contacting your Erie agent or calling directly, a claims adjuster will call you immediately to examine the accident information and car insurance policy. When working with them, have the following details ready to expedite things:

- Policy and Claim Numbers

- Agent and Claims Handler Contact Info (Name, Email, Phone)

- Communication Records (Emails, Estimates, Phone Notes)

Then, you’ll examine your vehicle repair choices so you can get back on the road. The adjuster for your claim will go over the information you provided. The choices are available if you have private, company, or garage car insurance from Erie.

If you’re curious about the difference between filing claims for comprehensive coverage and filing claims for collision coverage, the good news is that it’s the same.

Erie’s discounts for upfront payments make it one of the cheapest auto insurance companies.

Chris Abrams

Licensed Insurance Agent

Finally, Erie will try to resolve your claim as soon as possible. Most claims are resolved rapidly; however, how long it takes for an auto insurance company to pay out a claim varies depending on the accident’s nature. A slight fender bender, for example, is processed more quickly than a claim with several vehicles, property destruction, and bodily harm.

If you need assistance filing a claim and making repairs, you may turn to your trusted mechanic or the one Erie suggests. Contact your claims adjuster and ask them about the eligible companies participating in Erie’s Direct Repair service. Companies involved in this program will assess the harm, provide an estimate, and then make the repairs.

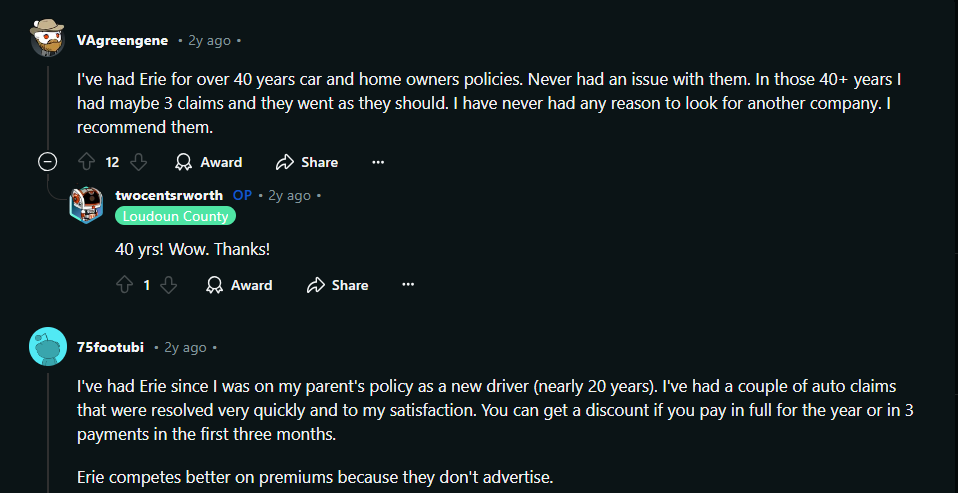

Reddit users have plenty of good things to say about Erie Insurance. One person shared that they’ve been with Erie for over 40 years, had only a few claims, and never felt the need to switch.

Another mentioned nearly 20 years with Erie, quick claim resolutions, and loving the discounts for upfront payments. People on Reddit also like that Erie keeps premiums low by not spending too much on advertising.

Tracking Your Erie Auto Insurance Claim Made Simple

That’s what you need to know about how to track your auto insurance claim with Erie. Whether you choose to do it through an agent, through the 800 number, or on the app, make sure you have all your information ready to go so you can find out the status of your claim and if there’s anything you need to do to speed it up.

True or False: Cranking the A/C will actually defrost your windows faster. ❄️ https://t.co/QkVwFTWUaw

— Erie Insurance (@erie_insurance) January 29, 2024

If you ask, “What should I do if my auto insurance claim is denied?” your agent can help you explore options and next steps. You can find the best auto insurance prices no matter how much coverage is needed by entering your ZIP code into our comparison tool today.

Frequently Asked Questions

How do I find out when I made an insurance claim?

Log in to Erie’s online portal or mobile app to view your claim history and details.

What is the phone number for Erie property claims?

Call Erie’s property claims hotline at 1-800-367-3743 for assistance.

Is Erie insurance 24/7?

How do I account for an insurance claim received?

Record the settlement amount in your financial records and keep supporting documents for future reference.

How do I find out how many no-claims I have?

Check your policy details or contact your Erie agent for a record of your no-claims history.

Use our free comparison quote tool to save more on your auto insurance.

How do I email a claim?

Why is Erie Insurance so cheap?

Erie offers competitive rates by focusing on regional markets and customer-centered policies.

How do I contact Erie customer service?

Call Erie customer service at 1-800-458-0811 for general inquiries.

Is Erie Insurance in Florida?

Florida is not one of the 12 states or the District of Columbia where Erie Insurance operates. Still, if you’re looking for cheap Washington auto insurance, you must explore other options in Washington state.

How can I support my claim?

Provide detailed documentation, such as photos, receipts, and police reports, to strengthen your claim.

What is Erie Insurance’s best rating?

Erie holds an A+ rating from A.M. Best for financial strength and stability.

What is the process of insurance claims?

What is the letter of claim for insurance?

A letter of claim notifies the insurer of a loss and outlines the details for initiating the claims process.

What is proof of no claims?

Proof of no claims is a document from your insurer verifying the number of claim-free years on your policy.

Who normally has the cheapest car insurance?

What is the grace period for Erie car insurance?

Erie typically allows a grace period of 15 days for policy renewal payments, but confirm with your agent.

Who owns the Erie Insurance Company?

Erie Insurance is a publicly traded company owned by its shareholders.

Does Erie charge a cancellation fee?

Erie may charge a cancellation fee depending on your state and policy terms. If you need to cancel your auto insurance, contact your agent for details and to understand any potential charges.

How long does it take for insurance claims to settle?

Erie settles most claims within 12 days, depending on the complexity and documentation provided.

Find your cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

What is the insurance claim received?

It refers to the payout or settlement amount received from the insurance company.

Compare over 200 auto insurance companies at once!

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi…

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.