Crum & Forster (C&F) Insurance Agency administers Hartville Pet Insurance, similar to ASPCA Pet Insurance. Hartville’s waiting periods are a little longer for accidents than other companies, but some of their other waiting periods are more competitive. But will their policy cover your pet’s greatest needs? Let’s learn more about Hartville Pet Insurance and discover whether they could be a solid solution to manage the financial risks associated with pet ownership.

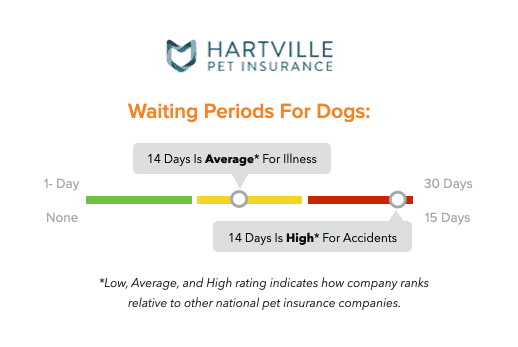

Hartville has a 14-day waiting period for both accidents and illnesses (which is a little long for accidents compared to competitors). However, its waiting period for CCL surgery and hip dysplasia is only 14 days, which is extremely short compared to others.

The main reason our experts haven’t chosen Hartville as a top pick in our pet insurance reviews is because customers report reimbursements are lower than they expected and claim repayment is slow.

Hartville Pet Insurance Reviews

Product Name: Hartville Pet Insurance

Product Description: Hartville offers pet insurance for dogs and cats.

Summary

Hartville Pet Insurance has a longer accident waiting period, and customers report lower reimbursement and slower claim processing. However, it offers the basic coverage you expect from an insurance provider.

Our pet insurance experts read through each pet insurance company’s policy to provide detailed comparisons and information regarding how a provider fares against others in the industry. We also speak with customers, read online feedback, and communicate one-on-one with pet insurance companies to obtain a well-rounded, unbiased analysis of a company’s standings.

Our team rates pet insurance companies based on several factors, including A.M. Best ratings (an indicator of financial stability), claim processing reputations, contract coverage, customer service, pricing, plan customizations, and more.

Pros

- Optional wellness plan (must purchase in conjunction with pet insurance)

- Conditions that are free of symptoms and treatment for 180 days prior to enrollment aren’t considered pre-existing conditions

- No upper age limits for coverage 30-day money-back guarantee

- Your pet is covered when they travel with you in the U.S., Guam, Puerto Rico, U.S. Virgin Islands, and Canada

- Accident-Only plan available

Cons

- $2 transaction fee, if not paying annually

- Can’t change/add some items to plan until the next 12-month period begins

- Low reimbursements reported by customers

- 14-day waiting period for accidents is longer than competitors

- Claim repayment is longer

Key Features

- Underwriter:United States Fire Insurance Company (Crum &Forster)

- A.M. Best rating (a measure of financial stability):A

- Bilateral exclusions (a condition or disease that affects both sides of the body):conditions involving a ligament,patella,meniscus,or soft tissue disorder of the knee

- Claims process:

- Submit claims via app,online via member center,email,fax,or mail

- Claim processing currently averages 15-30 days, and direct deposit and check are both options

- Covers curable pre-existing conditions if it has been cured and free from treatment and symptoms for 180 days (ligament and knee conditions are excluded)

Customer Service Options &Hours

- Phone &email:

- Monday — Friday:9am-6pm EST

- Monday — Friday:9am-6pm EST

Waiting Periods*

- Illnesses:14 days

- Accidents:14 days

- Cruciate Ligament:14 days

- Hip Dysplasia:14 days

*Waiting periods for California,Delaware,Louisiana,Maine,Mississippi,Nebraska,New Hampshire,and Washington are as follows:

- Accidents – 0 days

- Illnesses – 14 days

- Cruciate Ligament Conditions – 30 days

- Routine Care – 0 days

Hartville also offers a 10% discount for each additional pet.

How Does The Claim &Reimbursement Process Work?

Hartville uses a “deductible then copay” reimbursement method. This is calculated in the following way:

- Actual vet bill amount – Remaining annual deductible – Copay=Reimbursement amount

Consider All Your Pet Insurance Options

Hartville isn’t our first pick for a pet insurance policy. However,we’ve reviewed dozens of pet insurance companies and chosen the best options based on coverage,customer service and reputation,claim processing,price,plan customizations,and more. You can also use our free tool below to get multiple pet insurance quotes instantly.