To account for differences in disease burden across a Medicare Advantage (MA) plans patient population, uses risk adjustment based on patient disease burden. Specifically, MedPAC notes that:

Medicare uses beneficiaries’ characteristics, such as age and prior health conditions, and a risk-adjustment model—the CMS hierarchical condition categories (CMS– HCCs)—to develop a measure of their expected relative risk for covered Medicare spending.

In February 2023, CMS CMS published a notice of proposed rulemaking to update their HCC risk adjustment algorithm (v28). These changes included (i) leveraging ICD-10 rather than ICD-9 codes as the primary building blocks, (ii) use of 115 HCC indicators rather than 79, and (iii) constraining some coefficients to be identical across severity levels (e.g., diabetes, heart failure). The new algorithm will be phased in during 2024–2026.

One key question is whether providers under traditional Medicare (TM) code differently than Medicare Advantage (MA) plans. Because MA plan payment from CMS depends on patient severity, there is an incentive to up-code diagnoses. A paper by Carlin et al. (2024) aims to evaluate whether or not this occurs. They first explain the mechanism through which MA plans could more fully capture patient secondary diagnoses:

MA plans have an opportunity to review medical records to ensure that providers did not accidentally omit a diagnosis from encounter records. These reviews are more important when the providers’ reimbursement does not incent detailed coding of the patients’ secondary diagnoses. MA plans to make corrections to add or (rarely) delete a diagnosis through CR records. In addition, both MA and TM providers may record additional diagnoses through a HRA [health risk assessment] during a wellness visit or a home visit for this purpose.

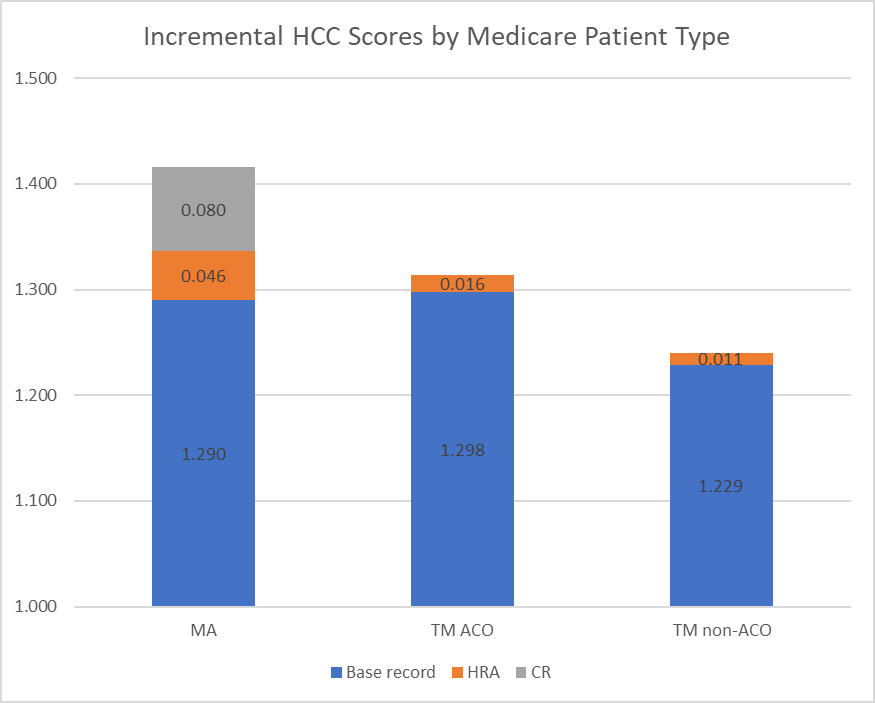

The authors use 2019 CMS claims data and divide the data into 3 cohorts: MA plans, TM beneficiaries attributed to ACOs (“TM ACO”), and TM beneficiaries not attributed to an ACO (“TM non-ACO”). ACO includes patients attributable to accountable care organizations (ACO), such as those participating in the Medicare Shared Savings Program (MSSP). The authors note that the TM non-ACO cohort serves as a key comparison since they are not subject to the same coding intensity incentives experienced by MA plans and TM ACOs (since ACO shared savings also is risk adjusted).

The authors identify patients who had a HRA based on whether they had an annual wellness visit, initial preventive physical exam, or selected home health visits (following the Reid et al. 2020 algorithm). The authors also use information from encounter claims on whether a patient chart review took place. Using these data, the authors propensity-score matched the MA, TM ACO, and TM non-ACO cohorts. The authors then compare the matched and unmatched HCC scores and evaluated how the HRA and CR visits impacted the HCC risk scores. They find:

Incremental health risk due to diagnoses in HRA records increased across coverage cohorts in line with incentives to maximize risk scores:+0.9% for TM non-ACO,+1.2% for TM ACO, and+3.6% for MA. Including HRA and CR records, the MA risk scores increased by 9.8% in the matched cohort.

Diagnosis codes related to vascular conditions, congestive heart failure, and diabetes had the largest contribution to average HCC score across all 3 cohorts. Vascular, pscyh, and congestive heart failure were most likely to increase due to HRA/CR coding intensity activities.

While other papers have claimed Medicare Advantage have upcoded diagnoses for more favorable reimbursement, this paper clearly specifies not only the magnitude of the impact, but also the mechanism through which it is most likely to occur. You can read the full paper here.